Digitalization: Africa to Become a Top Services Outsourcing Destination in Case Productivity Gets Better

by Fintechnews Africa 21 June 2023In Africa, improved productivity, increased digitalization and a rapidly expanding talent pool are laying the foundations for the continent to become a major services outsourcing destination, a new report by McKinsey and Company says.

The report, released on June 05, 2023, looks at Africa’s economic, social and demographic trends to determine the major business challenges and opportunities arising from the continent, making a case for why Africa’s services sector is poised to become a critical growth driver of the continent’s economy.

According to the report, services are creating significant opportunities for the continent’s nations to boost economic output and job creation. Taking the productivity growth rate observed in the sector between 2000 and 2010 of 1.8%, services are poised to create an additional US$400 billion worth of gross value added (GVA) by 2030 and produce at least 85 million net new jobs by then, the report says.

Real productivity in Africa has been among the lowest of any region in the world, amounting to US$7,200 in 2019 compared with US$8,900 for India, and US$20,900 for China, the report notes. But if productivity were to improve substantially, matching for example the productivity growth of Asia’s strongest services hubs, the economic gain and employment growth would be tremendous, adding US$1.4 trillion to the continent’s economy and almost doubling the GVA from services today, as well as creating 225 million jobs by 2030, the consultancy estimates.

Over the past two decades, Africa has been undergoing a structural shift to services, with employment in the sector increasing from 30% to 39%. Over that period, services secured its place as the major driver of the continent’s economic output, contributing 50% to the continent’s GVA in 2020 and 56% in 2019.

Sector employment, %, with total jobs in Africa, Source: McKinsey and Company, June 2023

Among key services subsectors, financial and business services, which encompasses banking, insurance, scientific research and development, travel agencies as well as and rental and leasing activities, was found to be the category that’s the most productive, contributing more than one-third of the GVA created from 2000 to 2019 but less than 10% of the employment shift over the same period.

Africa’s services subsectors, Source: McKinsey and Company, June 2023

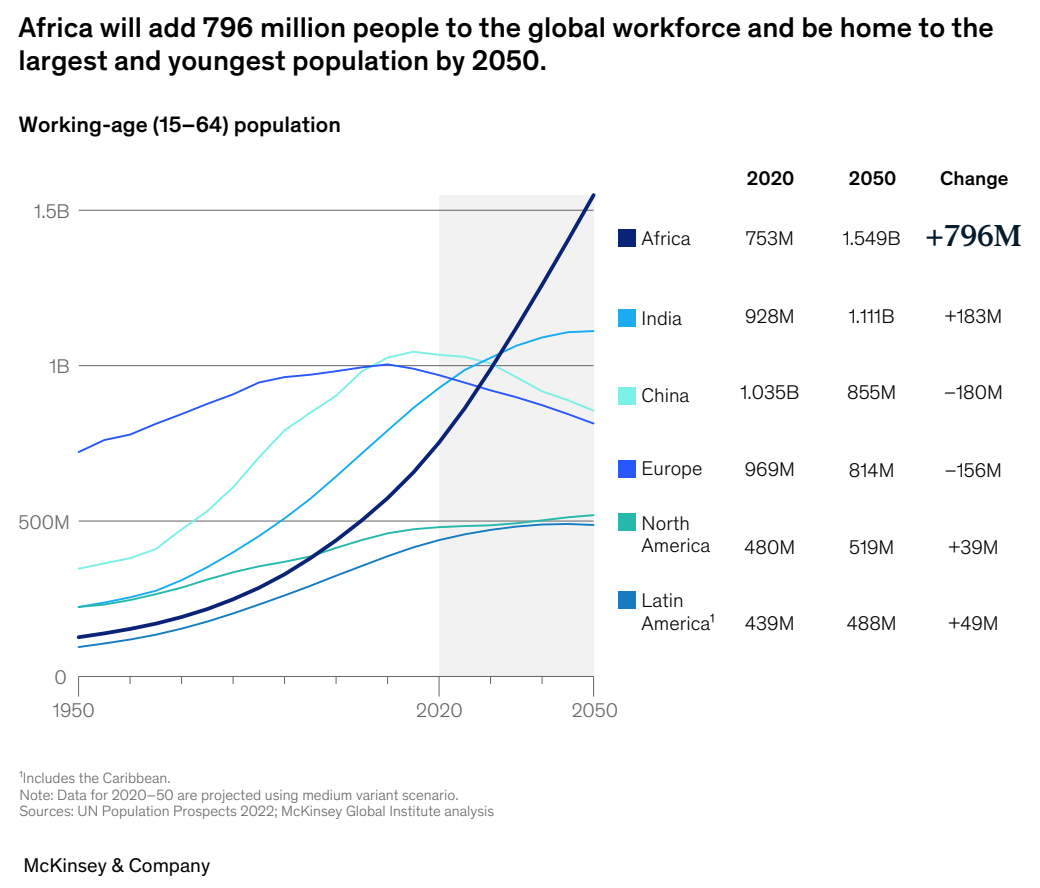

Improving productivity will not only help boost economic growth but will also create the jobs needed to sustain the continent’s burgeoning population, the report says. By 2050, Africa is projected to be home to the world’s largest working-age population, adding some 796 million people to its workforce by then.

These numbers suggest that Africa will not only be able to absorb the new labor market entrants in highly productivity work, the continent could also become a services outsourcing destination as the talent shortage continues to amplify.

Global workforce growth through 2050, Source: McKinsey and Company, June 2023

Targeted interventions, including developing skills, exporting talent and increasing digitalization, will help Africa raise its productivity, the report says. By fully embracing digital technologies and systems in all areas of the economy, countries and companies can drive innovations and improve productivity in ways that solve real societal problems. More and better data and data analytics mean that companies will be able to identify growth opportunities and tailor offerings across the diverse continent.

Digital skills will also be important to develop among the continent’s young talent, the report notes, especially since companies around the world will increasingly turn to Africa as a source of talent.

Africa has been undergoing a digital transformation, driven by the rapid expansion of mobile phones and Internet connectivity. This emerging transformation taking place on the continent is evident in the vibrancy of its technology startups, which numbered more than 5,000 in 2021, data from McKinsey shows.

Across all startup sectors, fintech is the largest and favored segment, securing 39% of all equity funding and 45% of the total debt volume in 2022, data from venture capital (VC) firm Partech show. The sector is represented by some of the continent’s fastest-growing and most valuable startups, including Flutterwave, a payment infrastructure provider originated from Nigeria and valued at US$3 billion; OPay, a mobile-based financial platform for payments, transfers, loans, savings and more, headquartered in Nigeria and valued at US$2 billion; and Wave, a mobile money startup from Senegal that’s worth US$1.7 billion.

Featured image credit: Edited from freepik.

1 Comment so far

Jump into a conversation