Fintech Retains Crown as Investors’ Favorite Startup Sector in Africa

by Fintechnews Africa 8 February 2023In 2022, fintech remained the most funded startup sector in Africa, accounting for 39% of all equity funding (US$1.9 billion) and 45% of the total debt volume (US$691 million), data from venture capital (VC) firm Partech show.

The figures were revealed in the newly released 2022 Africa Tech Venture Capital report, an analysis that looks at the state of the continent’s startup ecosystem and shares emerging trends and funding metrics.

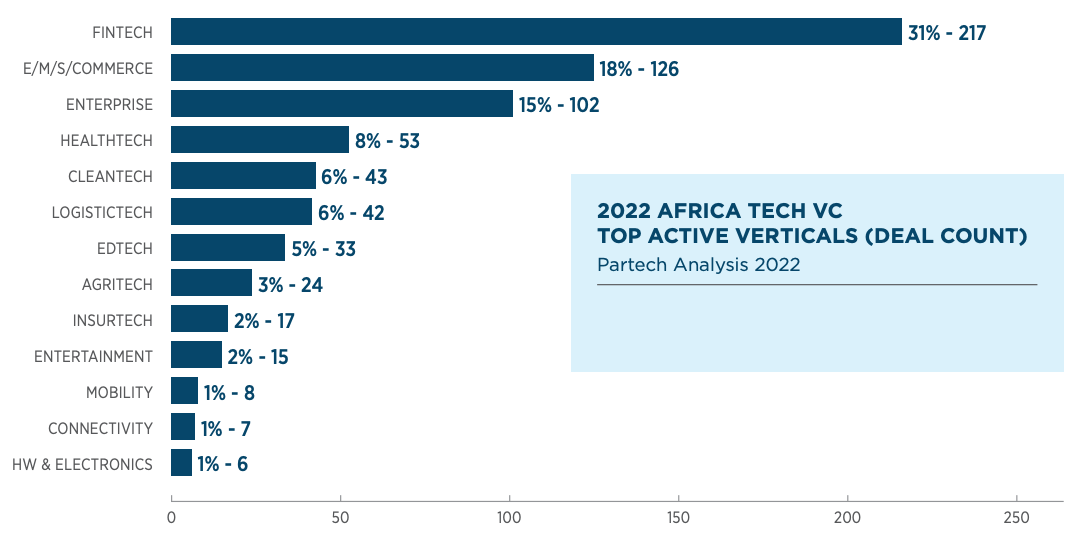

According to the report, a total of 217 fintech equity deals were secured in 2022 in Africa, representing a 31% market share and making the sector the most dynamic one in the continent.

2022 Africa tech VC, top active verticals (deal count), Source: 2022 Africa Tech Venture Capital, Partech, Jan 2023

Looking at national trends, data show that fintech dominated in six out of eight of the continent’s biggest funding recipients, ranking as the top startup segment in terms of volume in Nigeria, South Africa, Egypt, Ghana, Senegal and Uganda.

2022 Africa tech VC, equity funding by vertical in top markets (in US$M), Source: 2022 Africa Tech Venture Capital, Partech, Jan 2023

In dollar amount, Nigeria led the pack, securing nearly US$800 million in funding, followed by South Africa, with a little than US$390 million raised, and Egypt with more than US$260 million.

Nigeria, South Africa and Egypt are home to some of the continent most well-funded and fastest growing fintech companies. These include Opay, a Nigerian payment platform worth US$2 billion; Jumo, an online marketplace for consumer and business loans and mobile-based banking channels from South Africa that has raised US$278 million in funding; and MNT-Halan, an Egyptian fintech and e-commerce ecosystem provider that just reached unicorn status after securing earlier this month a US$400 million equity and debt financing.

These three leaders were followed by Ghana, Kenya and Senegal with US$115 million, US$95 million and US$94 million respectively.

Combined, those six countries accounted for 91% of the amount raised by fintech companies in 2022.

African startup funding in 2022 by vertical, Source: 2022 Africa Tech Venture Capital, Partech, Jan 2023

Notable fintech deals secured in 2022 in Africa include Interswitch’s US$110 million round (Nigeria), MFS Africa’s US$100 million debt and equity round (South Africa), Wasoko’s US$125 million Series B (Kenya).

Funding to African fintech companies declined last year, dipping 41% year-on-year (YoY) in 2022, according to Partech data. The trend is consistent with what was observed globally last year during which fintech funding declined by 46% from 2021 levels.

A thriving startup ecosystem

2022 saw a massive pullback in venture funding as investors began focusing on cash flow and profitability amid an increase in borrowing costs and a slowdown in initial public offerings (IPOs). Data from Crunchbase show that global VC investment dropped by 35% YoY, declining from US$681 billion in 2021 to US$445 billion in 2022.

Despite the global downturn, the African tech ecosystem continued to grow in 2022, securing a total of US$6.5 billion, according to the Partech report. The sum represents a 8% increase compared with 2021.

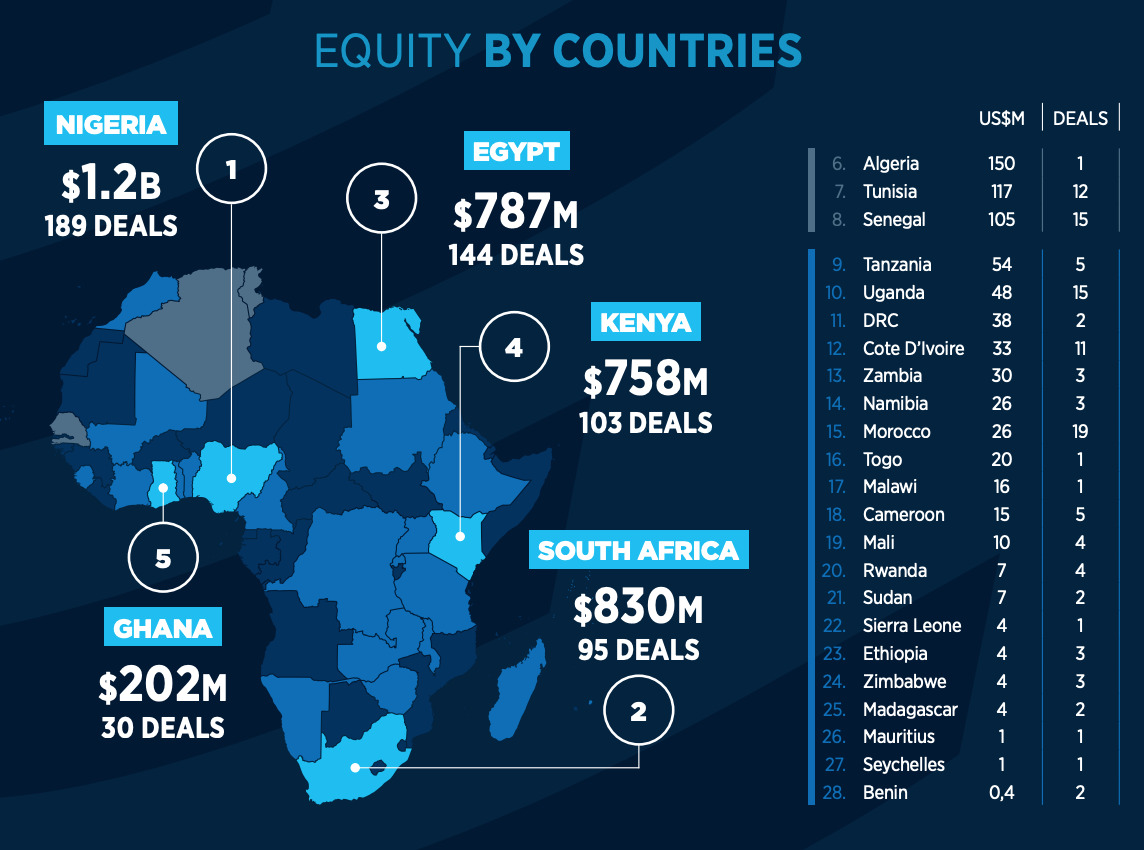

In 2022, Nigeria, South Africa, Egypt and Kenya remained the top investment destinations in Africa, with a combined share of total volume at 72%. Nigeria retained the first position, securing a total of US$1.2 billion, followed by South Africa (US$830 million), Egypt (US$787 million) and Kenya (U$758 million).

Africa equity funding by country, Source: 2022 Africa Tech Venture Capital, Partech, Jan 2023

These four countries, sometimes referred to as Africa’s “big four,” are home to the continent’s largest startup ecosystems, clocking 562 active startups for Egypt, 490 for South Africa, 481 for Nigeria and 308 for Kenya, data from Disrupt Africa, a startup news and information portal, show.

According to the African Development Bank’s (AfDB) 2021 report, these four nations account for about a third of Africa’s startup incubators and accelerators and receive 80% of foreign direct investment (FDI) into Africa.

Nigeria, South Africa, Egypt and Kenya pushed ahead faster than other African nations when it comes to startup investment and funding mainly because of their large economies and sizeable populations, the AfDB report notes.

Nigeria has a gross domestic product (GDP) of about US$440 billion, making it the largest economy in Africa. The country also has a massive population of 206 million and is projected to be the third largest country by population in the world by 2050. Like Nigeria, South Africa, Egypt and Kenya boast some of the largest economies in Africa with US$420 billion, US$404 billion and US$110 billion GDP respectively.

Featured image credit: edited from freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.