In Africa, fintech maintains its position as the most dynamic and fastest-growing startup segment, attracting the lion’s share in startup funding and dominating other categories in terms of unicorn count, new reports by local media and information services platforms show.

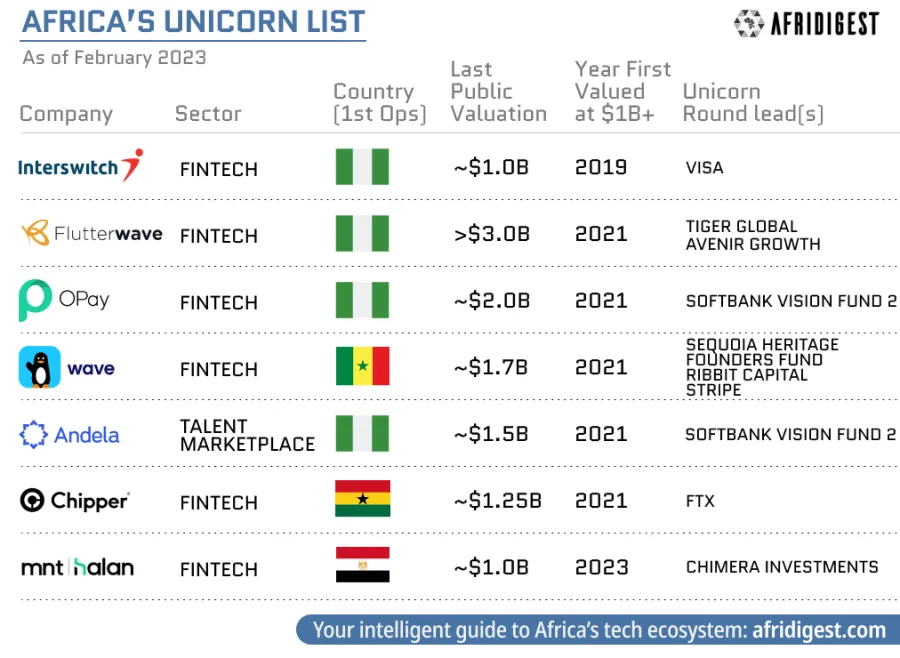

A report by Africa-focused tech information platform Afridigest, released on February 11, looks at the continent’s unicorn startups, revealing that out of the seven billion-dollar companies present in Africa as of February 2023, six are fintech companies.

Africa’s unicorn startups, Source: Afridigest, Feb 2023

These companies primarily target the African market, and include both those headquartered in the continent and overseas. Most operate in the digital payment and mobile money spaces, but some also tackle domains like digital lending.

Africa’s six fintech unicorns are:

- Flutterwave, a payment infrastructure provider originated from Nigeria and valued at US$3 billion;

- OPay, a mobile-based financial platform for payments, transfers, loans, savings and more headquartered in Nigeria and valued at US$2 billion;

- Wave, a mobile money startup from Senegal that’s worth US$1.7 billion;

- Chipper Cash, a cross-border payments company that’s worth US$1.25 billion and which operates in seven African countries including Ghana, Nigeria and Uganda;

- Interswitch, an Africa-focused integrated digital payments and commerce company worth US$1 billion and headquartered in Nigeria; and

- MNT-Halan, Egypt’s largest and fastest-growing lender to the unbanked population valued at US$1 billion.

MNT-Halan is the latest fintech company to join the unicorn club, having secured in February a US$400 million equity and debt funding round at a billion dollar valuation. The company, which provides a digital ecosystem and super-app that connect consumers, merchants and micro-enterprises with business loans, consumer finance, payments, buy now, pay later (BNPL) arrangements and e-commerce offerings, said it would use the proceeds to expand internationally after solid growth in Egypt.

Flutterwave, OPay, Wave and Chipper Cash all reached unicorn status in 2021 during the startup funding frenzy, data from CB Insights show. Interswitch, meanwhile, has been on the list the longest, having reached the billion dollar valuation milestone in 2019 after raising a rumored US$200 million funding round from Visa.

In terms of funding amount, it is OPay that has secured the most venture capital (VC) funding at US$570 million, according to African tech-focused publication Tech Cabal. OPay is followed by Flutterwave with a total of US$475 million, according to CB Insights and Dealroom; MNT-Halan with more than US$380 million in disclosed funding; Interswitch with US$321 million; and Wave with US$200 million.

In addition to these seven industry leaders, Africa is also home to a number of up-and-coming fintech startups that are well en route to reaching unicorn status, according to tech entrepreneur and investor Axel Peyriere.

These so-called fintech soonicorns have secured notable rounds of funding and have a valuation of US$500 million and up. They include TymeBank, a digital banking startup from South Africa that’s valued at about US$900 million; Jumo, a South African banking-as-a-service (BaaS) platform for entrepreneurs that’s valued at about US$850 million; and TeamApt, a Nigerian fintech startup building financial platforms and products for businesses that’s worth around US$800 million.

Africa’s startup funding landscape

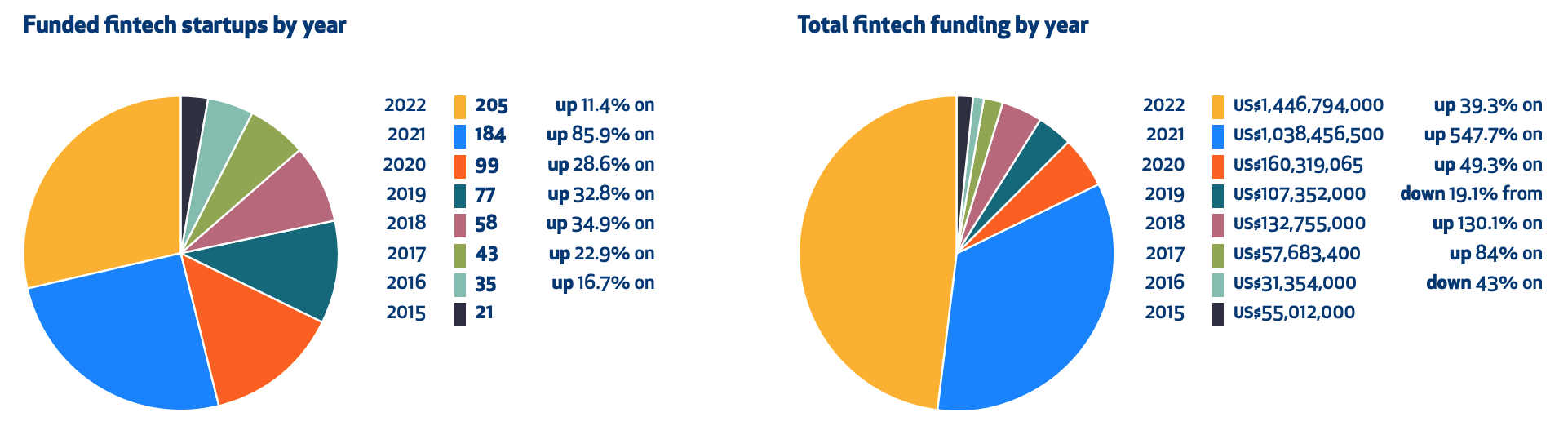

Against all odds, fintech funding activity in Africa continued to rise in 2022, growing 39.5% year-over-year (YoY) to reach US$1.5 billion, data from Disrupt Africa’s latest African Tech Startups Funding Report show.

The trend is contradictory to what was observed in 2022 during which global fintech funding declined by 46% YoY as investors scaled back their investment pace amid slumping public markets.

205 African fintech startups received funding in 2022 for an average deal size of US$7 million. The figures represent an improvement from 2021 during which 184 companies secured funding and deal sizes averaged US$5.6 million. This showcases the maturing of the sector where startups are raising larger rounds of financing to support their expansion and to scale up.

Fintech funding in Africa by year, Source: African Tech Startups Funding Report 2023, Disrupt Africa, Feb 2023

In 2022, fintech remained the most funded startup sector in Africa, accounting for a staggering 43.4% of the continental total.

Nigeria led the pack by contributing US$666.4 million or 46.1% of all fintech funding, followed with Egypt with US$402 million (27.8%), South Africa with US$132.6 million (9.2%) and Ghana with US$96 million (6.6%).

African startup funding by sector, 2022, Source: African Tech Startups Funding Report 2023, Disrupt Africa, Feb 2023

At least 987 different investors supported Africa’s startup landscape in 2022, according to the Disrupt Africa report. The most active ones include early-stage funds Launch Africa Ventures, LoftyInc Capital Management and Future Africa, as well as accelerators Y Combinator, Techstars, Flat6Labs and Startup Wise Guys.

An analysis by Africa: The Big Deal, a database and insights platform on startups funding in the continent, found Launch Africa Ventures to be the most prolific investor in Africa with at least 124 deals across 19 countries in 2021 and 2022. The figure gives it a rate of more than one deal signed each week on average. According to the analysis, the firm got involved in 12% of all equity deals between US$100,000 and US$10 million that happened on the continent in the past couple of years.

Fintech companies in Launch Africa Ventures’ portfolio include AfriEx, a remittance platform from Nigeria; AlphaDirect, a direct-to-customer insurtech startup from Botswana; Balad, a remittance-driven neobank from Egypt; Bitmama, a cryptocurrency exchange from Nigeria; and Kuda, a leading digital challenger bank in Nigeria.

After Launch Africa Ventures, Flat6Labs was identified as the second most active startup investor in the region. A seed and early stage venture capital (VC) firm and the operator of one of the leading startup accelerators in the Middle East and North Africa (MENA) region, Flat6Labs participated in at least 88 rounds of funding in 2021 and 2022 for an average of more than three deals signed per month.

Fintech companies in its portfolio include InvoiceQ, a software-as-a-service (SaaS) e-invoicing platform from Jordan; Agel, a Sharia-compliant trade finance platform from Egypt; and Bayt Misr, a digital mortgage platform from Egypt.

Top investors in Africa in 2021-2022 by number of US$100,000+ deals, Source: Africa: The Big Deal, Feb 2023

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.