Tanzanian Fintechs Struggle With Unclear Regulation, Limited Funding, Lack of Talent

by Fintechnews Africa 29 November 2021Although the fintech ecosystem in Tanzania has developed rapidly over the past decade, it remains nevertheless small and nascent with just 33 pure fintech players identified.

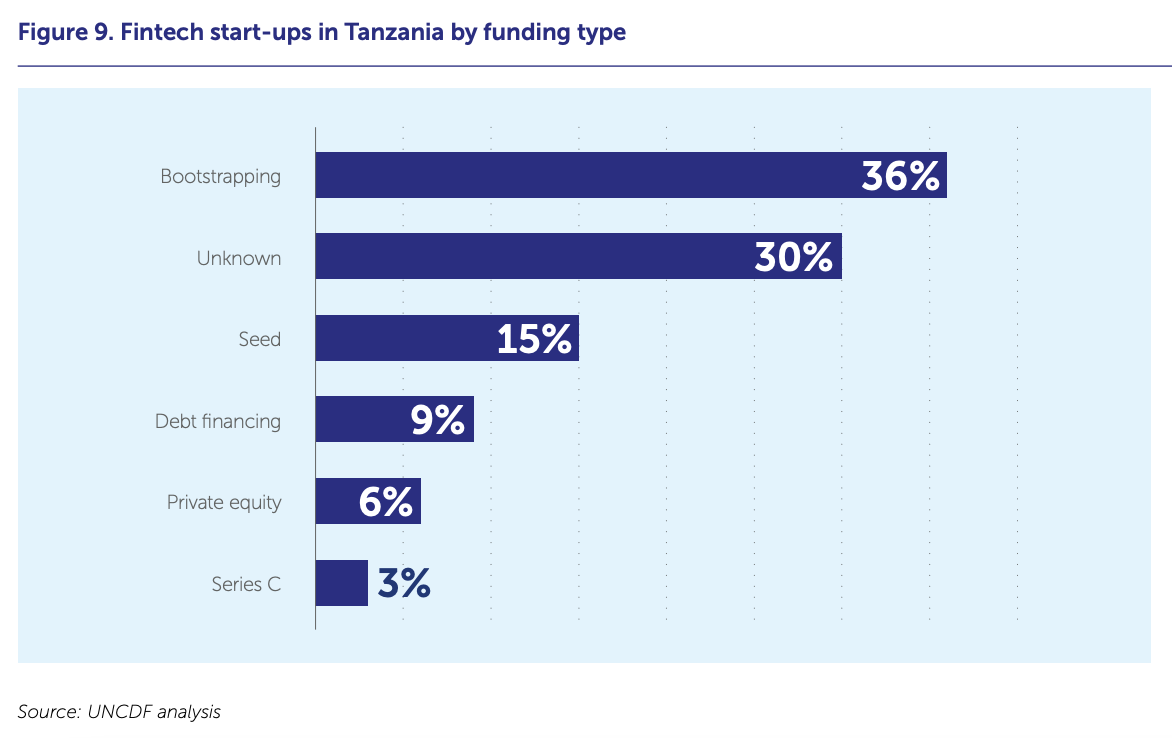

Out of these companies, only 36% have managed to secure seed funding or growth financing, while 35% are still relying on bootstrapping funds from family and friends to support early-stage operations.

These figures show that domestic fintech startups are still struggling to raise capital, hampering the development of the overall industry, an industry assessment by the United Nations Capital Development Fund (UNDF), the Tanzania Information and Communication Technology (ICT) Commission and startup accelerator Sahara Ventures shows.

Fintech startups in Tanzania by funding type, Source: UNCDF analysis, 2021

These findings, drawn from desk research and interviews of local fintech players, were shared in the Fintech Start-Up Landscape in Tanzania report, released in May 2021.

According to the report, access to funding remains a key challenge in Tanzania, limiting the growth of fintech startups. Limited access to funding can be partly explained by investors’ low level knowledge of the fintech sector, as well as the missing middle when it comes to financing startups in the early stages of development, the research found.

The lack of talent was found to be another key challenge in Tanzania, respondents shared. In particular, they cited limited availability of skilled local talent and limited availability of mentors with practical startup experience to guide fintech founders.

Fintech professionals also named unclear regulation is another a major hurdle to the growth of the industry, stating that limited direct engagement between fintech startups and relevant regulators meant inadequate regulation around innovation. Additionally, some founders perceive that taxes levied on startups as a deterrent to entering the fintech space.

Tanzania’s fintech players

Fintech products and services in Tanzania are largely concentrated in the lending/financing segment (14 companies), as well as in payments/remittances (10 companies), but other segments are also represented including savings (5), insurance (4), enabling technologies (3) and personal finance (2).

Number of fintech startups in Tanzania by product, Source: UNCDF analysis, 2021

This concentration around online and payments means that there are still plenty of opportunities to tap into, the report says. In particular, the growing middle class and the proliferation of savings groups across all socio-economic classes, means that there’s a huge opportunity for fintech startups to design and test innovative business models around long-term savings, investments and wealth management, as well as personal financial management.

Additionally, Tanzania’s large population of rural and/or informal workers is providing fertile ground for insurtech and micro-insurance to thrive.

A large majority (91%) of Tanzanian fintech startups started out as consumer-facing fintechs, providing financial services directly to end users. However, over half today indicate to be operating as a hybrid business-to-business (B2B) and business-to-consumer (B2C) business model. For most, this is due to the need to balance resources and gain additional income to sustain operations, especially during COVID-19, the research found.

Fintech startups in Tanzania by business model, Source: UNCDF analysis, 2021

External data compiled for the research show that banking penetration in Tanzania is still very low with just 16.7% of adult having a formal bank account. However, alternative financial services including fintech products are surging in popularity.

Data from Finscope indicate that a vast majority of adults (72%) have used either a formal or informal financial product or service to manage their financial lives. In tandem, 39% of the adult population have a mobile money account and 43% either made or received digital payments in the past year.

Financial inclusion in Tanzania metrics, Source: UNCDF report, 2021

The release of the Tanzanian fintech ecosystem report came just a few months before the UNDF launched a Fintech Ecosystem Acceleration program in the country.

The program aims to build both fintech startups and accelerators by offering a range of custom-made services, and will focus on pre-identified gaps within the ecosystem including offering mechanisms for support spanning the critical stages of fintech startups from post-revenue to scale-up.

In addition, the organization said it will support efforts at expanding the formation and growth of startups, work with existing structures and provide a platform for different industry stakeholders to interact, collaborate and forge connections.

1 Comment so far

Jump into a conversation