Tanzanian Fintech Nala Raises $10M from Monzo and Robinhood Founders

by Fintechnews Africa 31 January 2022NALA, Founded by Tanzanian, Benjamin Fernandes (Founder & CEO). Led alongside, Nicolas Esteves (CTO), and Nicolas Eddy (COO), raised $10m round backed by Amplo, Accel, and Bessemer Partners with participation from Angels such as Jonas the co-founder & CTO of Monzo, Robinhood founder Vlad, Laura, the co-founder of Alloy, Deel founder Alex Boaziz and Peeyush Ranjan, the head of Google Payments.

Amplo’s GP, Sheel Tyle joins the board of NALA. Sheel sits on the board of Andela and has been a seed investor and former board observer in Robinhood.

NALA will be launching a crowdfunding campaign this year where their first users will get access to own shares in NALA.

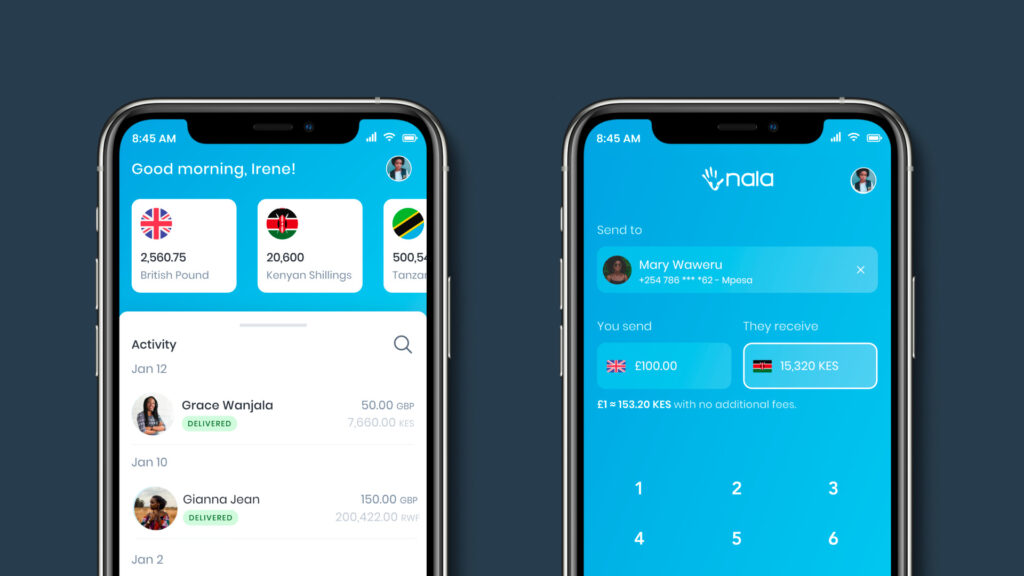

NALA is an app that enables you to make payments from the UK to Tanzania, Kenya, Uganda, Rwanda, and Ghana.

NALA Multi-currency accounts

This week, NALA is piloting NALA for businesses enabling people who run businesses in the to make payments to Africa.

NALA is in private beta with multi-currency accounts allowing the African diaspora to store local African currencies when abroad.

NALA is concurrently building payments rails to further reduce costs and allow other businesses to build on top of them and leverage these rails.

Expansion:

- NALA will be in 12 African countries by the end of the year including Nigeria to that list.

- NALA is aggressively expanding. They recently received permission to go live in the US (targeting a Q1 launch) and the European Economic Area (targeting a Q1 launch).

- NALA currently has 7 entities operating in countries including Tanzania, Kenya, Uganda, Ghana, and South Africa.

NALA recently struck a deal with Citi Bank Global to manage their FX and fast-track growth across different geographies, being one of the few African tech companies with this deal.

Compliance: NALA recently hired Subuola Abraham to lead compliance functions at the company. Subuola was the former group chief compliance officer at UBA Bank and GT Bank, two of Africa’s largest banks.

Benjamin Fernandes

Comment from CEO, Benjamin Fernandes:

“Payments in Africa are 1% build. It’s 2022 and Africa’s still the most expensive place in the world to send money in and out of, until this changes we are limited by the opportunities of trade across the continent. Over the next 5 years, while logistics gets better, more places around the world are going to trade in and out of Africa, we are positioning ourselves to be at the forefront of this change.”

180 Comments so far

Jump into a conversation