In the first half of 2023, businesses in Africa embraced digital transformation at a fast pace, fueling demand for innovative e-KYC verification solutions. This is evidenced by the surge in activity observed by Smile ID, the identity verification solutions provider says in a new report.

In Smile ID’s State of KYC in Africa H1 2023 report, the company looks back at fraud attempts it saw during the first half of the year, sharing insights into the evolving know-your-customer (KYC) landscape in Africa and delving into the state of identity verification across various countries and emerging fraud trends.

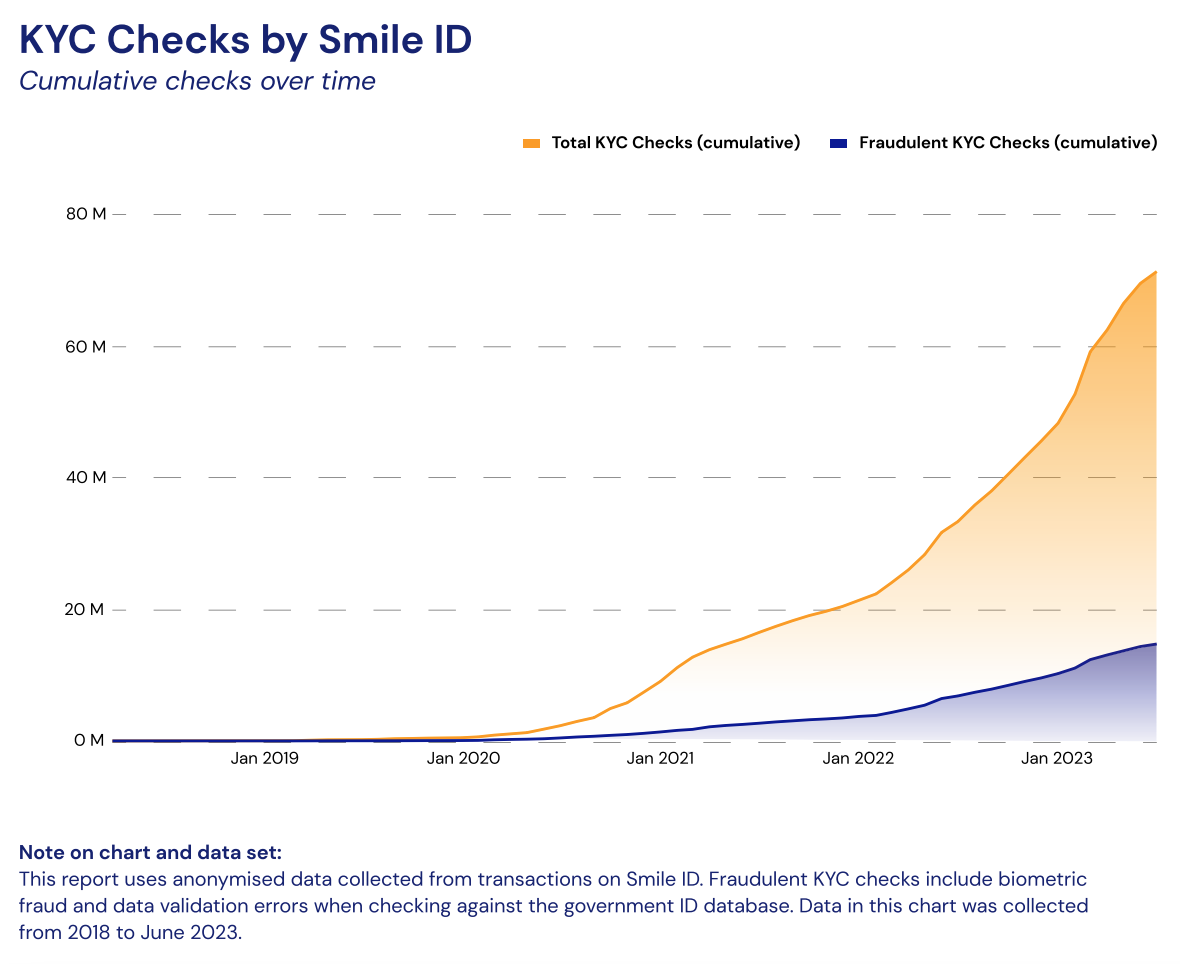

Smile ID reported skyrocketing demand for seamless digital identity verification solutions this year. In July 2023, the company had recorded over 75 million KYC checks since its inception, with an increase of more than 50% during H1 2023. This surge is indicative of rising adoption of digital identity verification in the region, Smile ID says.

Cumulative KYC checks by Smile ID over time, Source: The State of KYC in Africa H1 2023, Smile ID, July 2023

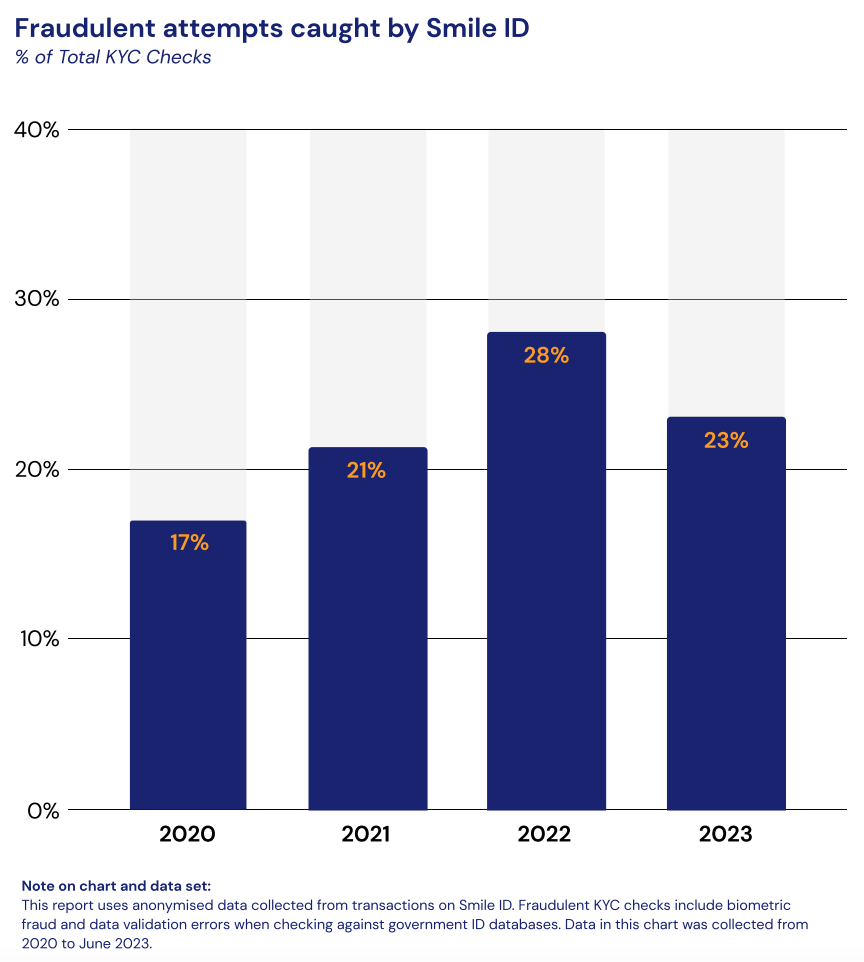

Drawing on data from these KYC checks, the firm notes that fraudulent onboarding attempts fell across Africa in H1 2023 as compared to the same period the previous year, decreasing by 5 points to 23% from a peak of 28% in 2022.

Fraudulent attempts caught by Smile ID as a percentage of total KYC checks, Source: The State of KYC in Africa H1 2023, Smile ID, July 2023

In addition to reduced fraud, the report notes that innovative identity verification solutions are allowing businesses to deliver improved customer experiences and onboard more users in a faster manner.

In major markets such as Nigeria, Ghana, Kenya, and South Africa, Smile ID claims it has reduced the average time for verification using popular identification documentations (IDs) to a mere 1.93 seconds.

Other key findings

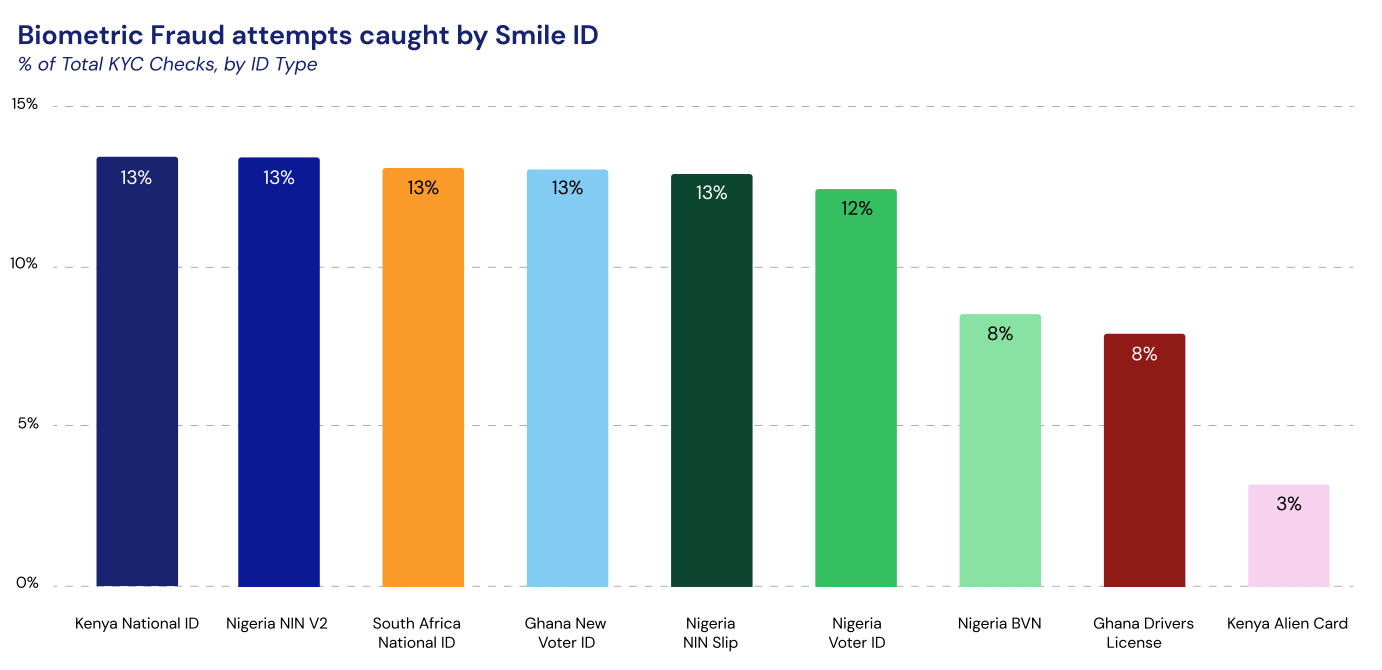

Delving deeper into the key trends observed in H1 2023, Smile ID notes that biometric fraud attempts observed during the first half of the year mainly targeted national IDs of Kenya, Nigeria and South Africa. These documentations were the three most frequently targeted types of IDs during the period, the study found.

Biometric fraud attempts caught by Smile ID by identification documentation type as a percentage of total KCY checks, Source: The State of KYC in Africa H1 2023, Smile ID, July 2023

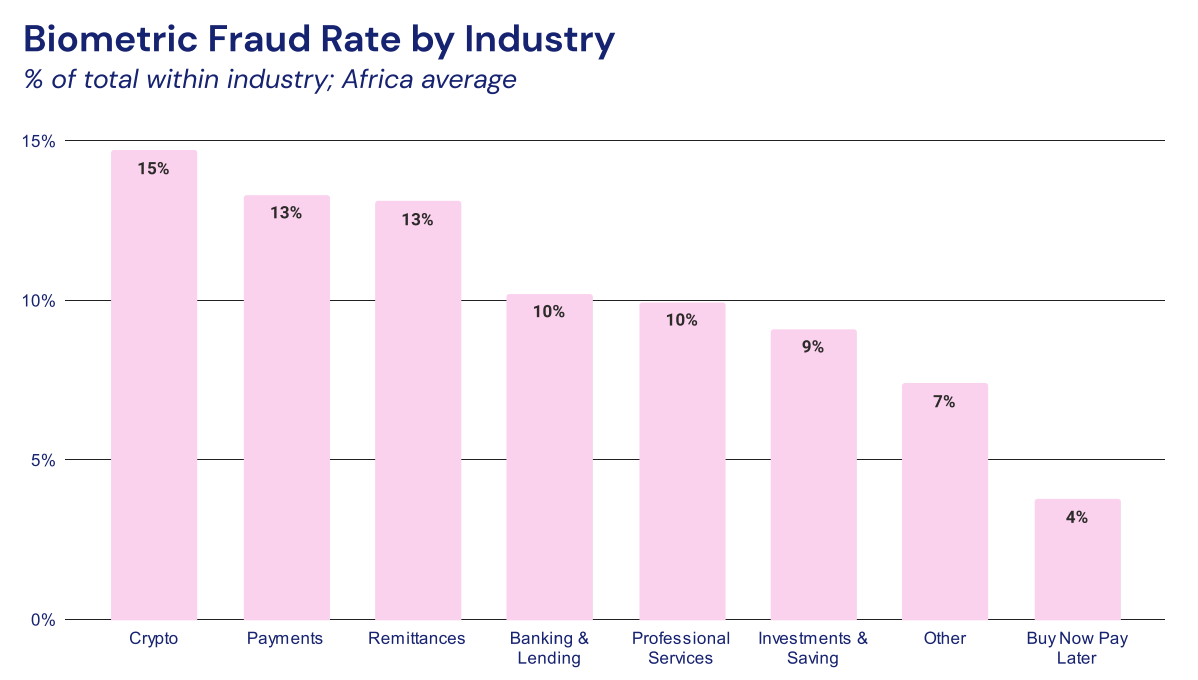

Looking more specifically at the different sectors, the analysis shows that fraud rates in the buy now, pay later (BNPL) space fell to a record low this year, slumping from 37% in H1 2022 to a mere 4% in H1 2023.

In contrast, Africa’s cryptocurrency sector continued to grapple with high fraud rates, making up 15% of all biometric fraud attempts in H1 2023. The payments and remittances industries, meanwhile, recorded a marked increase in fraud from last year, reaching 13% in H1 2023.

Biometric fraud rate by industry, Source: The State of KYC in Africa H1 2023, Smile ID, July 2023

Looking at national trends, the report notes that after seeing record-low numbers in H2 2022, fraud in Kenya is rising again this year.

In the first half of H1 2023, fraud attempts in the country grew from 10% in January 2023 to 17% in June 2023, the analysis shows. This increase in fraud attempts makes Kenya the highest-risk country for ID fraud compared to the other countries analysed, the report notes.

In contrast, South Africa, which finished 2022 as the country with the highest risk for ID fraud in the region, witnessed a significant drop in ID fraud.

Between January 2023 and June 2023, fraud rates in South Africa dropped from 17% to 8%, figures that make South Africa the lowest-ranking country for onboarding fraud and the only country with a single-digit percentage of fraud attempts, the report says.

Adoption of digital identity and E-KYC on the rise in Africa

Rising usage of digital identity verification solutions in Africa comes at a time when businesses across the continent are moving online.

Amid the wave of digital transformation, governments are racing to bring their identity systems up to date, eyeing technology and digital platforms to streamline administrative processes, access better personal data security, improve accuracy and increase efficiency of identity verification processes.

In Ethiopia, the government is implementing a nation-wide biometric digital ID system, aiming to register all eligible adults of its population of 120 million by the end of 2025.

The pilot of the digital ID system, which is called Fayda and is being backed by the World Bank, was announced in 2021 and includes an individual’s name and gender, iris scan and fingerprints, as well as date of birth, gender, address and photograph.

So far, a little over 1.4 million Ethiopians have been enrolled with Fayda, according to a September 2023 TechCabal report.

Ethiopia recently announced plans to make Fayda mandatory for all transactions with financial institutions to accelerate its financial inclusion ambitions. The move would allow bank customers to use Fayda as their bank ID to carry out KYC checks and complete remote onboarding.

In Kenya, the government is planning to start rolling out its new digital ID this month after four pieces of the country’s digital identity plan were approved earlier this month, Kenyans.co.ke reported on September 12, 2023.

And most recently, Somalia launched its biometric identity card system in an effort to combat security threats, terrorism and identity fraud, Prime Minister Hamza Abdi Barre said during the launch event on September 16, 2023. The government plans to register 15 million Somalis for the national digital ID scheme by the end of 2026.

Featured image credit: edited from freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.