Posts From Sharon Lewis

Fintech Digest: South Africa Gears up for New Crypto Regulatory Framework

South Africa will be launching a new regulatory framework for cryptocurrencies in early 2022 (Bitcoin.com). The country’s Financial Sector Conduct Authority (FSCA) announced that it would be unveiling a crypto regulatory framework for the trading of crypto coins. “What we

Read More4 Things You Should Know About the African Fintech Industry: Report

The African fintech industry has grown by leaps and bounds, no doubt. VC dollars have flooded the startup market, mobile money is all anyone can talk about, and regulators are watching this space ever so closely. A number of other

Read More5 Out of 7 Tech Unicorns in Africa Come From Fintech

Africa is seeing a rush of funding for its fintech sector, and some companies have already emerged as the continent’s biggest fintech bets, becoming unicorns in Africa. African fintech companies have raised more in the first seven months than they

Read MoreReport: Africa’s Top Fintech Hubs Are Also Its Most Regulated

The development of Africa’s top fintech hubs is closely connected with how robust its regulatory landscape is, a new report by Afriwise points out. The report, titled “Catch me if you can: How regulators will impact Africa’s Fintech sector,” notes

Read MoreMEA Fintech Weekly News: Dubai Gets Regulatory Nod for Crypto Trading

In last week’s MEA fintech news, it’s all eyes on crypto trading in the UAE – approvals for crypto trading at a Dubai-based free zone make their way through, while BitOasis registers on an anti-money laundering system in the country.

Read More4 CBDC Projects in Africa You Need to Know

Central bank digital currencies, or CBDCs, are not a new concept to Africa. Multiple CBDC projects in Africa currently exist, even amidst a wider fintech boom across the continent. In an interview, Dr. Co-Pierre Georg, an expert on CBDCs, explains

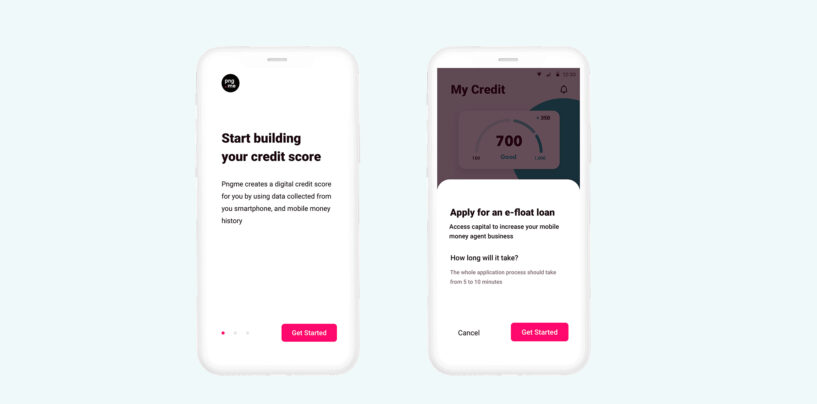

Read MoreAfrica-Focused Fintech Pngme Gathers US$15 Million Series A

Africa-focused fintech Pngme has secured US$15 million in Series A round of funding, the San Francisco- and Sub-Saharan Africa-based company has announced. The funding comes within a year of the startup’s US$3 million seed round. London-based VC fund Octopus Ventures

Read MoreQIA Infuses US$200 Million Into Airtel Africa’s Mobile Money Business

Airtel Africa’s mobile money business has amassed US$200 million for its Airtel Mobile Commerce BV (AMC BV) from Qatar Holding, Airtel Africa announced. Qatar Holding is an affiliate business of Qatar Investment Authority (QIA). Of the total investment amount, US$150

Read More