Despite Growth and Potential, Fintech Development Faces Challenges in Nigeria

by Fintechnews Africa 20 October 2023In Nigeria, the fintech industry has expanded well beyond payment services to now encompass a wide range of segments, including regulatory compliance, credit and blockchain. This growth has been driven by mass adoption of digital financial services and increased collaboration within the sector to facilitate innovation.

But despite the strong growth that the Nigerian fintech industry has witnessed so far and the immense potential of the space to address financial and societal challenges, a number of obstacles are impacting the growth of sector in the country, including regulatory issues, infrastructure, investment funds, data security, and consumer management.

This is one of the conclusions formulated in a new report produced by Regtech Africa, a digital tech media platform based in Lagos, and Agpaytech, a fintech services company from the UK. The document, released on October 09, looks at the state of fintech and regtech in Nigeria, highlighting the opportunities and challenges that exist in the market, and exploring the emerging trends arising in the sector.

According to the report, Nigeria has recorded tremendous growth in its fintech sector over the past years, a growth that’s evidenced by soaring adoption of digital financial services, booming investment activity and the expansion of local players into new markets and niches.

Funding contraction

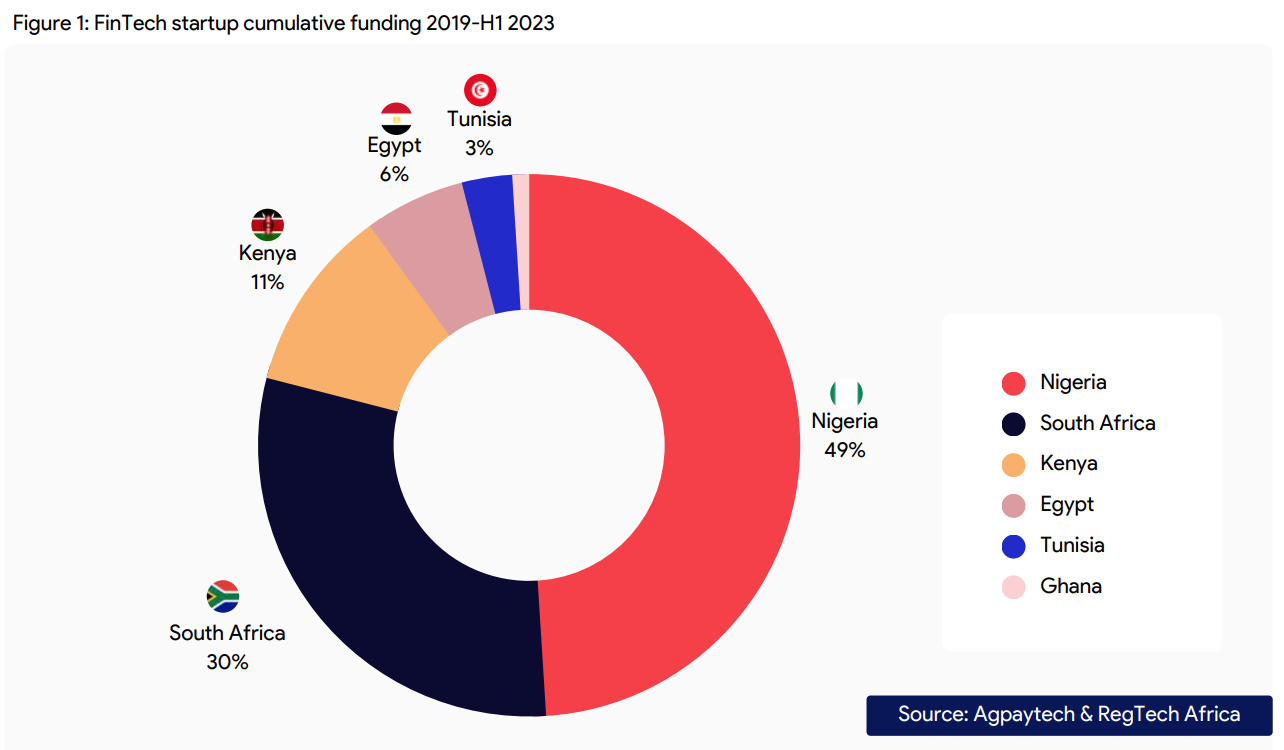

Nigeria has so far been the biggest recipient of fintech funding across Africa, securing nearly half of all investment raised by fintech startups in the region between 2019 and H1 2023, the data show.

Fintech startup cumulative funding 2019-H1 2023, Source: The State of Fintech and Regtech Report: Nigeria in Perspective, Regtech Africa and Agpaytech, Oct 2023

This year, fintech funding activity pulled back considerably in Nigeria as investor embraced a more cautious approach to investment amid the global economic slowdown, inflationary pressures and tightened monetary policy.

During the first half of the year, Nigerian fintech startups secured US$170 million in funding, the data show. The sum makes Nigeria only the fourth biggest nation in Africa in terms of fintech investment during the period, behind Egypt (US$445 million), Kenya (US$339 million) and South Africa (US$320 million).

The trend observed in Nigeria is consistent with what’s been seen globally. Data from both CB Insights and S&P Global Market Intelligence show that global venture capital (VC) to fintech startups declined by a notable 49% year-over-year (YoY) to reach US$23 billion in H1 2023.

Selected African countries and amount raised in H1 2023 and estimated at the end of 2023, Source: The State of Fintech and Regtech Report: Nigeria in Perspective, Regtech Africa and Agpaytech, Oct 2023

Fintech landscape shows diversification

In addition to fintech funding, the report takes a deep look at the startup landscape, noting that fintech has emerged into the most developed and largest segment. As of August 2023, fintech ventures represented over 40% of all startups in Nigeria, the data show, and these startups had garnered 42% of the total funds secured by tech ventures in the country.

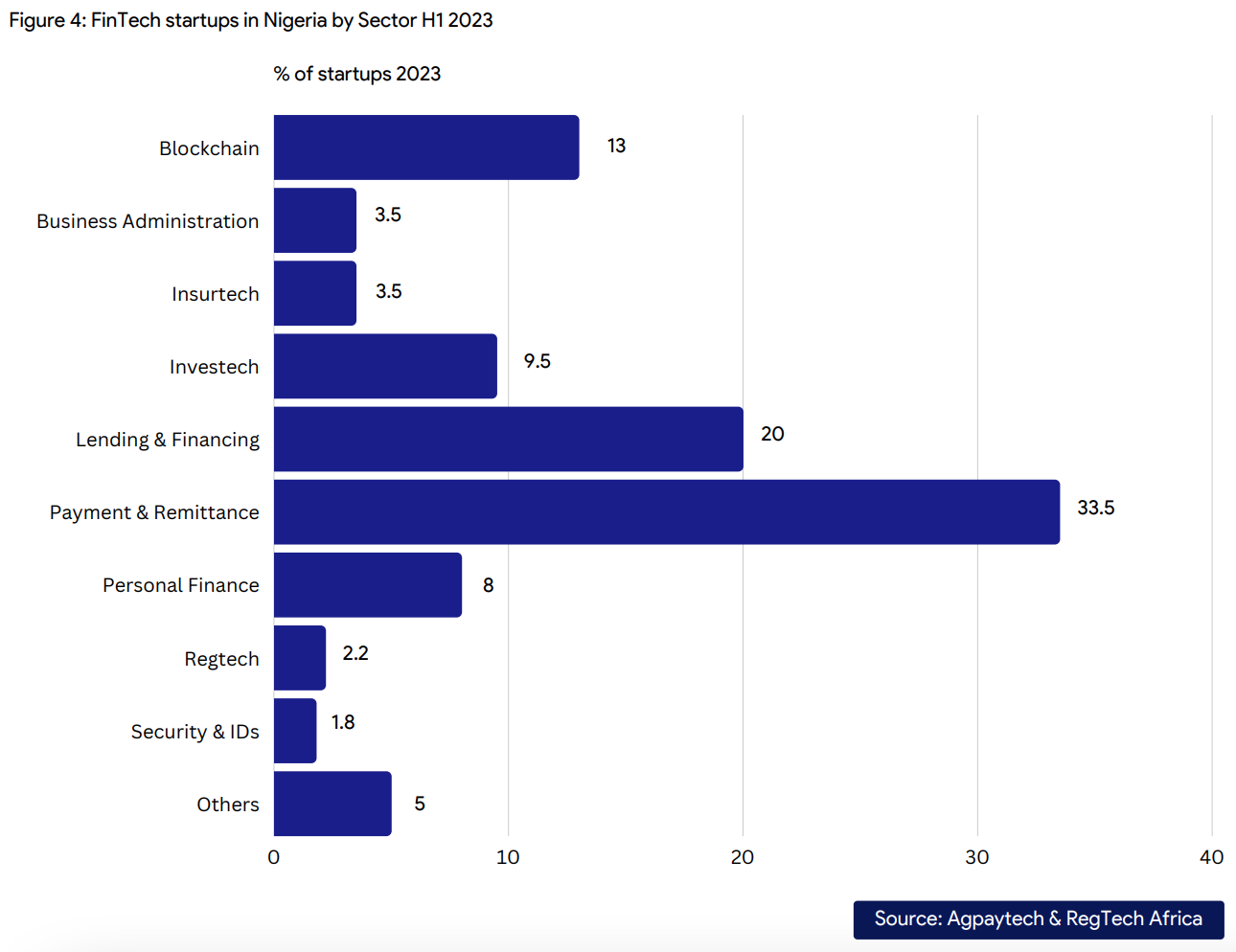

The report also stresses the development and maturing of the Nigerian fintech sector, noting that while payments remain the dominant segment by making up 33.5% of all Nigerian fintech startups, other verticals are emerging.

Lending and financing is one particular category that’s rising to prominence, accounting for 20% of Nigerian fintech startups in H1 2023. This is followed by blockchain (13%), investech (9.5%) and personal finance (8%).

Fintech startups in Nigeria by sector H1 2023, Source: The State of Fintech and Regtech Report: Nigeria in Perspective, Regtech Africa and Agpaytech, Oct 2023

Although regtech remains a small and nascent sector, it states that regtech solutions represent a crucial component in the Nigeria fintech ecosystem. These solutions are gaining popularity in areas such as regulatory reporting and compliance, anti-money laundering (AML) and know-your-customer (KYC) processes, and are expected to continue gaining traction moving forward as adoption of fintech increases and new rules get introduced. The report expects regtech to grow 40% among the startups in Nigeria by the end of 2025.

Adoption of fintech on the rise

In Nigeria, fintech is transforming many areas of the financial sector, the report says. In payments, platforms such as Paga, Flutterwave, and Paystack are leading innovation in mobile payments, facilitating transactions for individuals and businesses. In banking, digital-only neobanks such as Kuda Bank, ALAT by Wema Bank, and V Bank are offering comprehensive banking services exclusively through digital channels, eliminating the need for physical branch visits. And in lending, platforms such as Carbon, Renmoney, and FairMoney are simplifying access to financing by utilizing technology for swift and reliable credit underwriting, streamlining the borrowing process.

Adoption and usage of fintech solutions in Nigeria have increased considerably over the past years. From October 2022 to December 2022, the value of mobile-money transactions jumped by 25% to reach NGN 2.5 trillion (US$3.2 billion), ITWeb Africa reported earlier this year. Additional data from the Nigerian national payments system show that overall cashless transactions across the country grew by 45.4% YoY in January 2023 to reach around US$85 billion.

Obstacles to fintech growth

Despite substantial potential and growth, the Nigerian fintech industry is facing significant challenges that are hindering its growth.

For one, the sector is lacking explicit guidelines and regulations covering fintech activities, and there is currently no legal frameworks governing new business models and technologies such as cryptocurrencies. These circumstances are making the operational landscape uncertain for fintech companies and creating a risky environment for both businesses and consumers.

Additionally, Nigeria suffers from inadequate Internet penetration, poor network quality and overall infrastructure deficits. This hinders digital access and online financial operations, especially in rural and remote areas, and makes it challenging for startups to build and expand fintech services.

Another challenge outlined in the report is consumer trust issues where concerns over data security, privacy and rising online fraud and cyberattack incidences are eroding trust. It also notes the absence of comprehensive regulations for consumer protection in fintech, and says that redressal mechanisms are inadequate, limiting consumer recourse in resolving fintech-related disputes.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.