In recent years, the emergence of agritech and fintech providers in East and Southern Africa (ESA) has brought about innovative solutions designed to address the needs and challenges of smallholder farmers and underserved groups.

A new report released in May 2023 by the United Nations’ International Fund for Agricultural Development (IFAD) examines this landscape, analysing the myriad of agritech and fintech companies operating in the region and the innovations that these providers have introduced to the market.

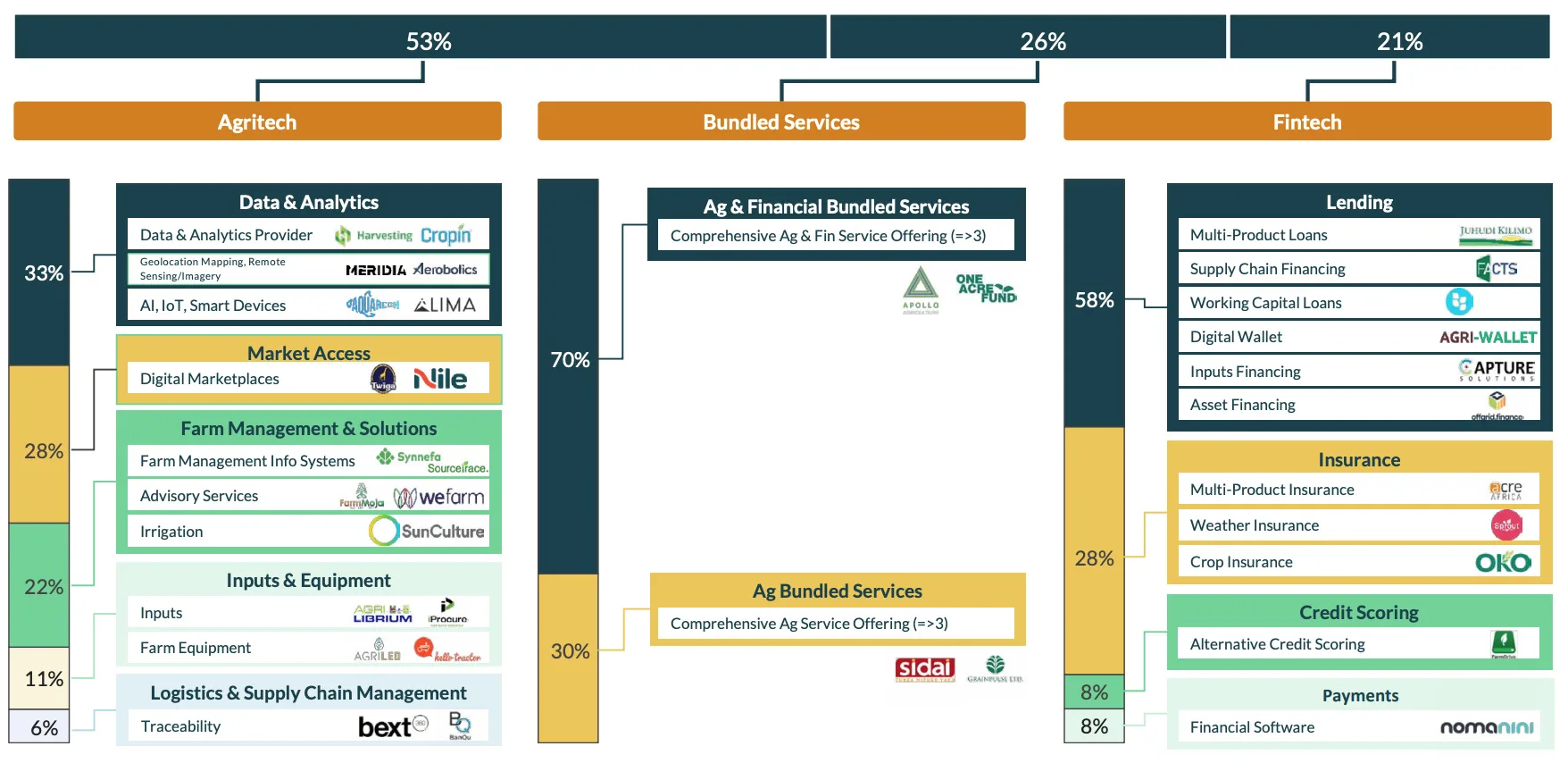

A mapping and analysis of tech solution providers in the ESA agricultural value chain reveals that pure agritech solutions currently make up most of the industry, representing 53% of all the companies in the sample studied. Bundled services, however, which include companies spanning multiple agritech solutions, is a segment that’s growing both in size and popularity, representing 26% of all companies. Finally, fintech companies that cater to the agricultural sector represent the smallest segment, making up 21% of companies.

Agritech and fintech landscape segmentation, Source: Agritech and Fintech Providers in East and Southern Africa: A Landscape Assessment, International Fund for Agricultural Development, May 2023

The report also puts a spotlight on some of the region’s most prominent agritech and fintech ventures. The following are five of the fastest-growing ESA companies providing farmers with innovative digital financial services.

Apollo Agriculture (Kenya)

Founded in 2016 and based in Nairobi, Kenya, Apollo Agriculture is a tech company that aims to support small farmers in rural Africa. The company provides a bundled service agriculture platform offering a comprehensive suite of services that includes access to credit, farm inputs, customized advice, insurance and markets, enabling farmers to improve productivity and increase their income.

Farmers apply for bundles of services such as seeds, fertilizers, location-specific advice and crop insurance. Once approved, Apollo Agriculture issues a voucher for farmers to redeem at local agro-dealers, which the company then pays off its own balance sheet. Farmers repay the value of their bundles once they sell their products after harvest.

Apollo Agriculture leverages machine learning (ML), remote sensing, and mobile payments to accurately underwrite farm credit risk. The startup has also built an automatically managed network of more than 5,000 agents and nearly 1,000 retailers that enables last-mile delivery of farm inputs and services to small-scale farmers.

Apollo Agriculture, which serves farmers in Kenya and Zambia, had worked with 100,000 customers by the end of 2021, TechCrunch reported last year. The startup has raised US$85.5 million in funding so far, according to the IFAD. Its latest round was a US$40 million Series B secured in March 2022. Apollo Agriculture said at the time that it would use the proceeds to expand geographically, enhance its products and technology, and keep building its team.

Pula Advisors (Kenya)

Founded in 2014 and headquartered in Kenya, Pula Advisors is an agricultural insurance and tech company that designs and delivers innovative agricultural insurance and digital products to help smallholder farmers endure yield risks, improve their farming practices, and bolster their incomes over time.

Pula Advisors is bundling agricultural inputs with insurance and agronomic advisory services, such as provision of inputs, farm monitoring, data, analytics and advisory services to cover the risk to smallholder farmers, while also increasing farm yield and climate resilience. The product uses technology such as remote-sensing data and drones to refine their yield insurance products and increase cost efficiency. It also utilizes an adaptive learning process to better serve farmers.

Pula Advisors operates under a business-to-business (B2B) model, working with banks and agricultural small and medium-size enterprises (SMEs) who subsidize its services at low or no cost to end customer. Partners gain access to Pula Advisors’ aggregated data on their customer base, reducing their portfolio risks.

Pula Advisors, which works across Africa and Asia, has insured more than eight million farmers so far, and surpassed US$69 million in gross premiums. The company has raised about US$9 million in funding, according to data from Crunchbase and Dealroom. The company’s latest round was US$6 million Series A secured in January 2021.

EzyAgric (Uganda)

Founded in 2015 and headquartered in Uganda, EzyAgric provides a value chain digitization platform designed to increase crop yield.

The company’s platform provides farmers with easy access to agro-inputs, credit financing, e-extension and advisory services as well as market linkages. It aggregates orders from customers to achieve economies of scale in the purchase of inputs and sale of produce, using its own warehousing and logistics operations to better manage seasonal demand for customers.

EzyAgric’s products and services include farming data and analytics, farm management and solutions, inputs and equipment, lending including buy now, pay later, and credit scoring through partnerships.

EzyAgric, which works through around 300 local agricultural shops, 600 village agents and 100 farmer associations as local hubs and agents, has impacted roughly 300,000 farmers since its inception and facilitates transactions worth millions of dollars per season, Mercy Angela Nantongo, a product manager at EzyAgric, told UG Standard last year. Of the 10,000 monthly active users of EzyAgric platform, she said over 80% are women.

EzyAgric raised US$2.5 million in Seed funding round in January 2021, data from Pitchbook show.

Oko Finance (Mali)

Founded in 2018 and headquartered in Mali, Oko Finance is a provider of mobile-centric micro-insurance products, offering crop insurance at affordable prices and instant claims processing.

The company, which operates in Mali, Uganda and Cote d’Ivoire, offers automated insurance using satellite imagery and mobile payments for farmers whose fields are negatively affected by weather patterns, mainly droughts and floods.

It partners with the most advanced weather information providers to obtain hyper-local data that can be used to define the risk with high precision and optimize the premium price, as well as automate the claim validation process by analysis of the historical data.

Oko Finance relies on innovative tools to distribute insurance in remote areas and to unbanked farmers. These include a USSD menu that allows farmers to manage their policies from any mobile device, a mobile app which provides a second-to-none customer experience and which is usable offline, as well as application programming interface (API) that lets partners like micro-finance institutions access relevant information securely.

As of July 2022, the company had brought insurance to more than 15,000 farmers in Mali and Uganda. Between 2020 and 2021, it claims it saw a sixfold growth in the number of paying customers.

Oko Finance raised US$1.7 million in a Seed funding round last year.

Emata (Uganda)

Founded in 2021, Emata is a digital lending provider from Uganda serving smallholder farmers. The company offers affordable digital loans that are specifically designed to empower farmers to invest in their farms and increase their revenue, leveraging artificial intelligence (AI) and advanced risk analytics to offer tailored loans that farmers can afford.

Leveraging technology and digital platforms, Emata says it is able to automate the entire loan process, from data collection and credit scoring, to loan disbursement, and offer loans as small as UGX 60 000 (about US$15).

Since its founding, Emata has partnered with 43 agricultural organizations and reached 38,000 dairy, coffee, maize, and oilseed farmers. The company has provided loans amounting to UGX 3 billion (US$810,000) to 2,500 small-scale farmers. These loans have resulted in an average 25% increase in farmers’ productivity for dairy farmers, Emata claims.

Emata was one of the winners of the 2022 Global Startup Awards, an annual independent startup competition that offers promising young ventures exposure to international markets, funding opportunities and access to a global network of leaders.

Featured image credit: edited from Unsplash

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.