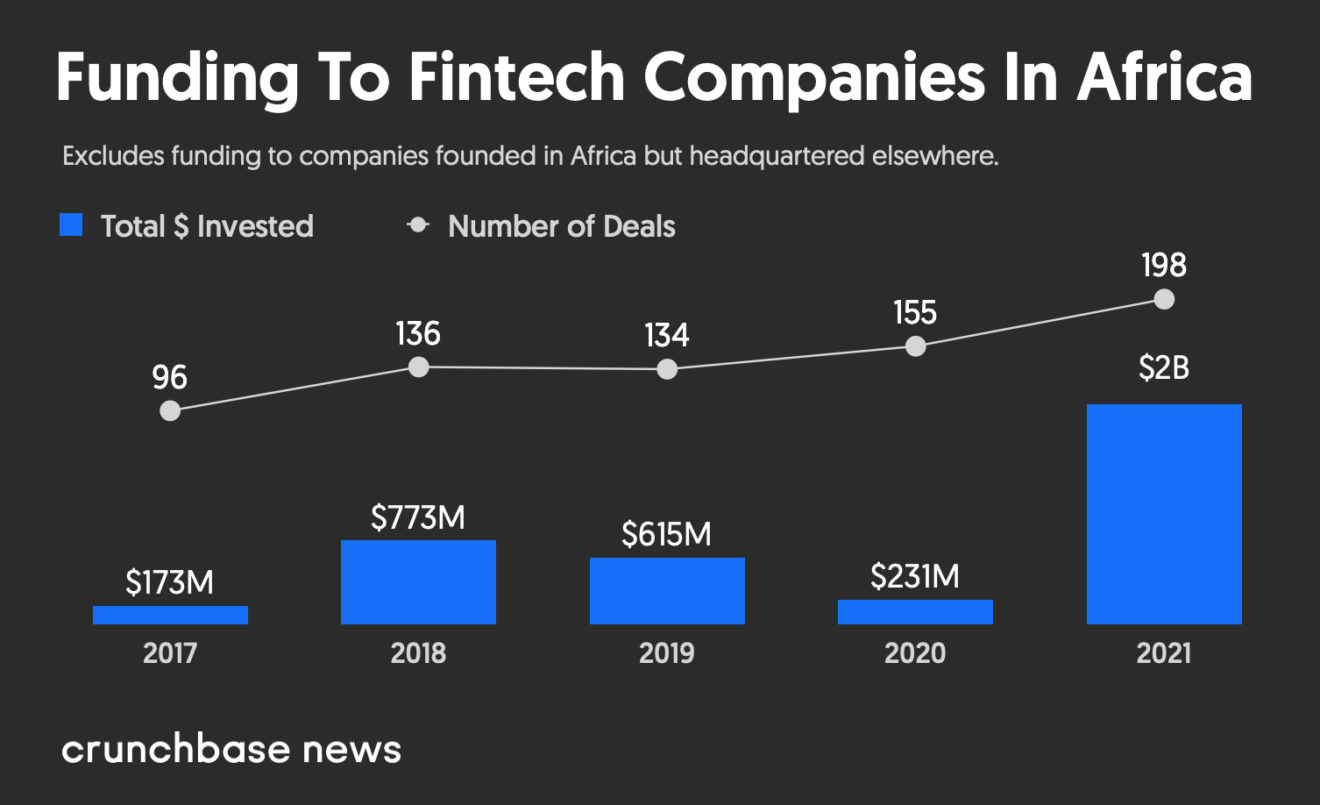

In 2021, African fintech startups raised a new all-time high of US$2 billion, surpassing the previous record of US$773 million raised in 2018 by 159% and overshadowing 2020’s figure of US$230 million by a staggering X8, new data from Crunchbase show.

Funding to Fintech Companies in Africa, Source: Crunchbase

2021’s sum, which excludes funding raised by African born startups but which are now headquartered overseas (e.g. Flutterwave and Chipper Cash), is reflective of the global surge in fintech funding observed last year during which fintech companies raised a whopping US$132 billion, more than double the 2020 figure.

In 2021, key markets remained Nigeria in the West, Kenya in the East and South Africa in the South. Other countries, including Egypt, also saw sizeable deals. Among the largest beneficiaries were mobile money service OPay (Nigeria), which raised US$400 million in Series C funding; Wave Mobile Money (Senegal), which raised a US$200 million Series A; digital bank TymeBank (South Africa), which raised a US$180 million Series B; as well as banking technology provider Jumo (South Africa) and micro-lender MNT-Halan (Egypt), which raised US$120 million each.

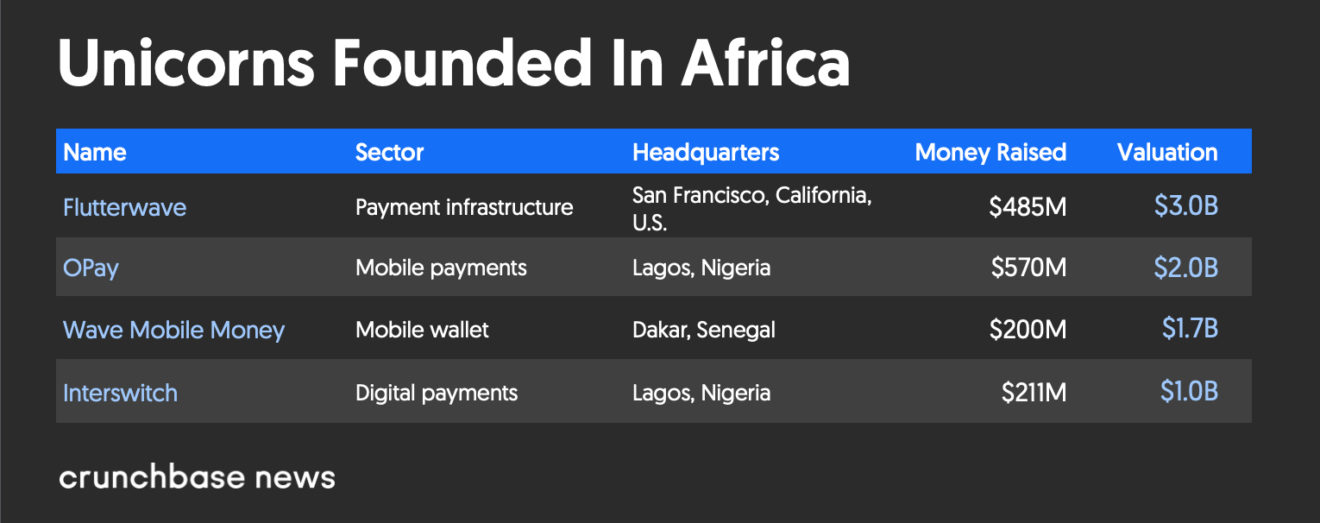

Booming fintech funding activity in 2021 pushed African fintech startups’ valuations further up. Last year, three fintech companies founded in Africa reached unicorn status: Flutterwave, a payment services provider, closed two mega-rounds in 2021 and is now valued at US$3 billion, OPay is worth a reportedly US$2 billion, and Wave Mobile Money crossed the billion-dollar mark in September and is now valued at US$1.7 billion.

These companies joined Interswitch Group, a Nigerian fintech company that specializes in digital payments and commerce. Interswitch Group reached unicorn status in 2019.

Unicorns founded in Africa, Source: Crunchbase

In terms of funding sources, 2021’s fintech funding activity in Africa was largely driven by foreign investors, with the US-based venture capital (VC) funds accounting for over a third of investment into Nigeria, according to KPMG’s Pulse of Fintech H2’21 report. Large corporates also participated with Visa and Fidelity, for example, taking stakes into Jumo.

Asian investors were also very active last year. Japan’s Softbank and China’s DragonBall Capital, Sequoia Capital China, Source Code Capital, Redpoint China and 3W Capital all took part in OPay’s US$400 million round, while Chinese tech giant Tencent invested in the growth rounds of payment gateway Ozow, and TymeBank.

Consolidation on the horizon in payment space; lending, SME finance as next growth areas

Though 2021 was a record year for fintech investment in Africa, the trend is showing no sign of slowing down, KPMG says, arguing that as smartphones continue to spread and as COVID-19 spurs digital adoption, the use of fintech services will only rise.

Digital payments and money transfers will continue to be a key area of focus for investors amid promising growth prospects in areas including remittances. During COVID-19, many African migrants were pushed towards digital transfer services, a shift which many industry executives believe will likely last as digital remittance services are typically cheaper, faster and safer than informal networks.

Alongside consumers, small and medium-sized enterprises (SMEs) are another promising market, especially when it comes to equipping merchants with the tools to accept digital payments, and other solutions to help them better manage their finance and access funding, KPMG says.

Another growth area is lending where artificial intelligence (AI), machine learning (ML) techniques and alternative data are providing fintech companies with the ability to assess the credit worthiness of those excluded from the formal banking industry.

Moving forward, KPMG expects Africa’s fintech industry to continue maturing with more development in areas that have so far remained largely untapped including wealthtech and insurtech. In the payment space, consolidation is on the horizon as fast-growing and well-funded startups continue to scale and eventually end up snapping up smaller players.

167 Comments so far

Jump into a conversation