Nigeria

Moniepoint Partners with Google Cloud in Nigeria

Google Cloud announced a new collaboration with Moniepoint, an Africa-focused business banking platform that provides financial services to Nigeria’s underbanked businesses residing in remote areas and communities. The collaboration makes financial services accessible at scale to millions of small and

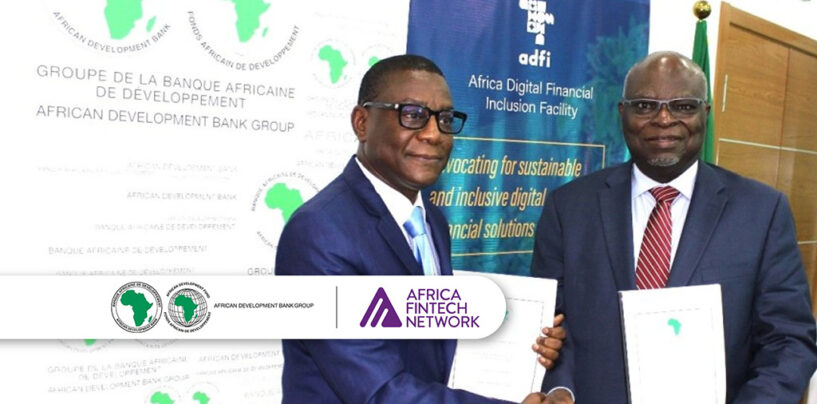

Read MoreFintech Hub: African Development Bank and Africa Fintech Network Sign $525,000 Grant

The African Development Bank has signed a $525,000 grant agreement with Africa Fintech Network AFN (not associated to Fintechnews.africa) for the setup of the Africa Fintech Hub, an online portal that will serve as a one-stop shop for all fintech

Read MoreAfrican Development Bank Invests US$170 Million to Create 6 Million Jobs in Nigeria

The African Development Bank has invested US$170 million in the newly-launched Investment in Digital and Creative Enterprises (iDICE) programme which aims to create 6 million new jobs for young Nigerians. Other partners in the programme include the French government which will

Read MoreFlutterwave Secures Payments Licenses in Egypt for North Africa Expansion

Nigerian payments company Flutterwave announced that it has received its Payment Services Provider and Payments Facilitator licenses in Egypt. This will enable Flutterwave to collect payments on behalf of its customers and settle payments locally and globally. The company will

Read MoreNigeria’s Agri-Fintech Sector On the Rise

In Nigeria, agricultural technology (agritech) entrepreneurs are leveraging technology and digital platforms to help tackle the massive funding gap faced by small and medium-sized agriculture businesses. This burgeoning sector is attracting the interest of funders and gaining support from organizations

Read MoreWorld Bank’s IFC Launches New Venture Capital Platform to Invest in Tech Startups

The International Finance Corporation (IFC) has launched a new US$225 million venture capital platform to invest in early stage companies in Africa, Middle East, Central Asia, and Pakistan. According to the IFC, these regions collectively received less than two percent

Read MoreAfrican Fintech Sector Attracts More Funding

The African fintech sector is gaining interest from global investors. Recently, Algerian super app Yassir announced that it had raised US$150 million in Series B funding – making it North Africa’s most significant funding to date. Participating investors led by

Read MoreNigeria’s Touch and Pay Wins the Ecobank Fintech Challenge 2022

Nigerian fintech Touch and Pay has won the 2022 edition of the Ecobank Fintech Challenge and with it a US$50,000 cash prize — said to be the largest no-strings attached fintech cash prize in Africa. The announcement was made at

Read MoreMeet the 6 Fintech Startups Competing in the Ecobank Fintech Challenge 2022 Finals

African banking group Ecobank Group has announced the six finalists for the fifth edition of the Ecobank Fintech Challenge, chosen from a pool of 700 applicants in 59 countries. Finalists will undergo a mentoring programme to explore funding opportunities and

Read MoreHere are the Top 5 Fintech Startup Funding Rounds in Nigeria

Nigeria is home to the largest number of startups and startup funding rounds in the last decade in Africa with 383 startups securing over US$2 billion from 2015 to 2022 — a large part of which involve fintech startups, according to

Read More