Posts From Fintechnews Africa

Nigeria’s Fintech Startups Leverage Advanced Digital Marketing Growth Strategies

In Nigeria, fintech companies are harnessing sophisticated digital marketing tools to drive growth, enhance brand visibility and build lasting relationships with customers in today’s digital-first world. Recent findings from the Africa Fintech Summit reveal that in 2023, Nigerian fintech enterprises

Read MoreRedefining Resilience for Banks in the Digital Era With the Four Zeros

The banking industry stands at the brink of a major transformation, driven by rapid technological advancements and changing customer expectations in a dynamic digital landscape. This transformation is not without its challenges, as banks grapple with the critical task of

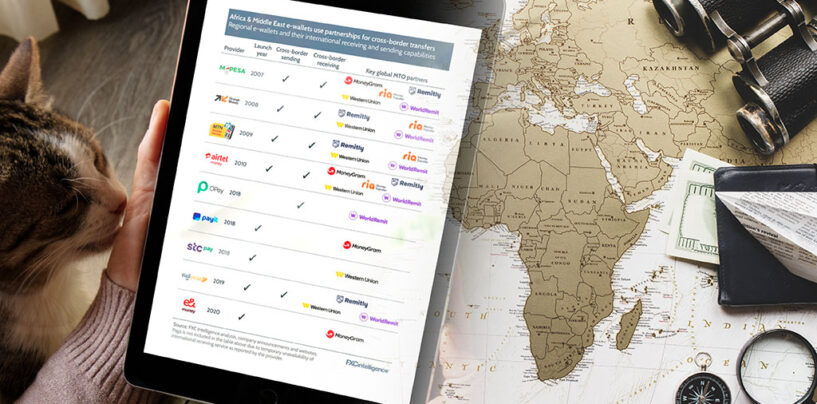

Read MoreTelco-Backed Platforms Leads E-Wallet Market in Africa and the Middle East

Africa and the Middle East boast 12 prominent e-wallets. These platforms are primarily provided by telecom companies, enable users to varied operations from the mobile phones, including payments, money transfers and remittances, and are gaining ground at a fast pace,

Read MoreFlutterwave Appoints Former Central Bank of Nigeria Director as Chairman

Flutterwave has announced the appointment of Dipo Fatokun as the new Chairman of Flutterwave Technologies Solutions Limited. He brings a comprehensive regulatory understanding and supervisory experience to solidify Flutterwave’s dedication to upholding the highest regulatory, compliance, and governance standards. Mr

Read MoreTop 10 Fintech Events in Africa to Attend in Q2 2024

Africa is emerging as one of the fastest-growing fintech markets globally. With half of the world’s mobile money accounts and successful fintech solutions like M-Pesa catering to the population’s needs, Africa’s fintech sector is blossoming. The continent is currently home

Read MoreBeing a Non-Bank Entity Gives M-Pesa Competitive Advantage

Despite M-Pesa appearing to emulate the operations of a bank, its true advantage lies in its distinct identity as a non-bank organization. This characteristic gives it an edge over competitors by enabling accelerated growth and by allowing it to respond

Read MoreSouth Africa Issues Draft Regulations for Digital Nomad Visa, Joining Namibia, Mauritius

South Africa is the latest country on the African continent to be jumping on the digital nomad bandwagon, joining jurisdictions such as Namibia, Mauritius and Cape Verde with a proposed immigration program targeting remote workers. Earlier this month, the South

Read MorePartech Africa Closes Fund Above $300 Million and Opens Office in Lagos

Partech, the global technology investment firm, announced the final closing of its second Africa fund, Partech Africa II, at a hard cap of €280M ($300M+), opens a new office in Lagos and is looking to hire more team members. Following

Read More10X Banking Expands to Africa

10x Banking, the transformational cloud-native SaaS core bank operating system founded by former Barclays CEO Antony Jenkins, has announced a partnership with Old Mutual as it expands into Africa and scales its evolving core banking system into new markets in

Read More10 African Startups Dominate 75% of Fintech Equity Africa Funding in 2023

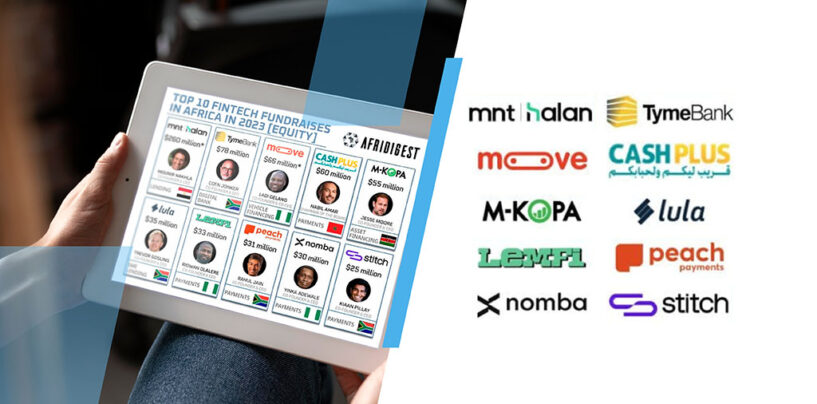

In 2023, 75% of all equity funding secured by African fintech startups went to ten companies. These firms, which span categories including digital banking and payments, raised a cumulated US$673 million in the top ten fintech equity rounds of 2023,

Read More