Africa’s fintech industry experienced growth in 2022, witnessing large financing rounds being closed, startups reaching unicorn status and innovative solutions gaining customer traction. The momentum positions the region’s fintech sector for further growth and success in the coming year, a new report by Financial Technology (FT) Partners says.

In a report titled Fintech in Africa: Momentum is Building and the World is Taking Notice, the fintech-focused investment bank looks back at the growth of the fintech landscape in Africa and trends emerging in 2022, sharing predictions for the year to come.

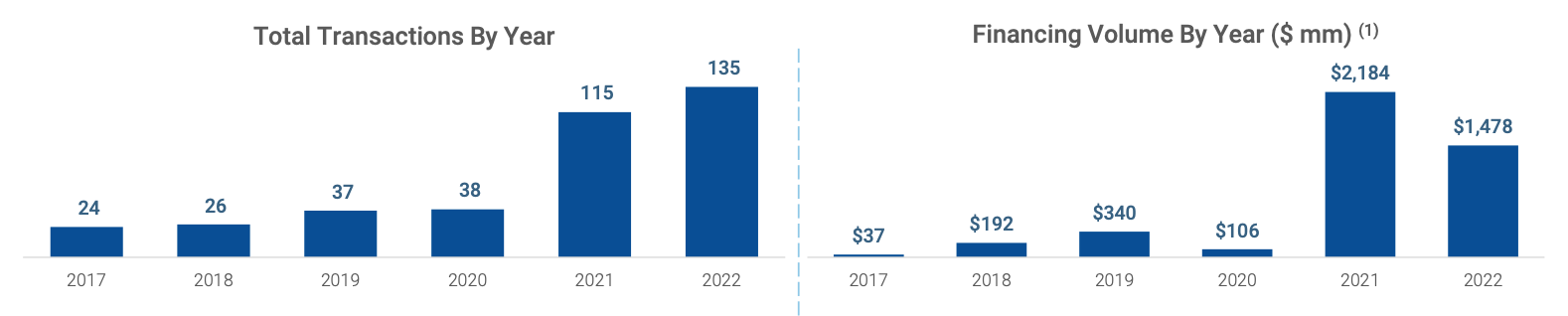

According to the report, 2022 saw some setbacks in fintech startup funding, reflective of global funding trends. Fintech funding dipped by more than 30% between 2021 and 2022, reaching about US$1.5 billion last year.

Despite the turnaround, 2022 was a record year for financing transactions with an announced deal volume in Africa of 135 transactions. The number, which represents a 17% increase from 2021, is a new record of the industry and showcases that investors are still bullish on the prospect of fintech in Africa, eagerly backing young and promising startups in the space.

Fintech funding in Africa, Source: Fintech in Africa: Momentum is Building and the World is Taking Notice, FT Partners, Jan 2023

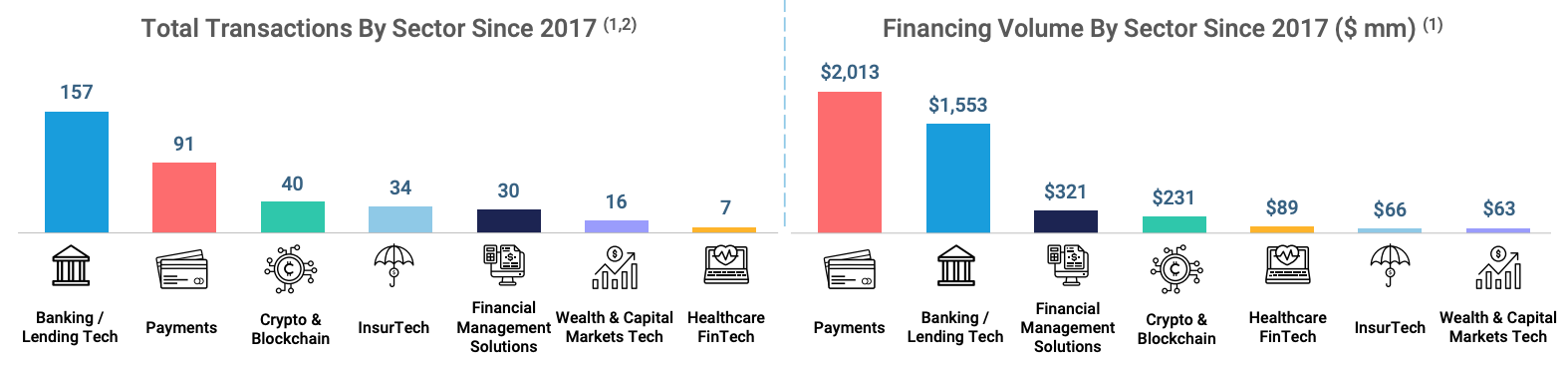

Looking at funding trends, data show that the payment and banking/lending tech subsectors have secured the most funding since 2017, amassing a total of US$2 billion and US$1.6 billion, respectively. The payment and banking/lending tech categories closed 157 and 91 deals, respectively, collectively accounting for more than 50% of fintech financing transactions.

Fintech funding in Africa by subsector, Source: Fintech in Africa: Momentum is Building and the World is Taking Notice, FT Partners, Jan 2023

Notable fintech deals secured last year by both Africa-based fintech companies and international fintech companies focused on Africa, include Interswitch’s US$110 million round (Nigeria), MFS Africa’s US$100 million debt and equity round (South Africa), Wasoko’s US$125 million Series B (Kenya) and Flutterwave’s US$250 million Series D (USA).

Interswitch is an African integrated payment and digital commerce platform company headquartered in Lagos; MFS Africa is a digital payment company that offers mobile financial solutions for senders, money users, and service providers headquartered in Johannesburg; Wasoko, formerly known as Sokowatch, is a business-to-business (B2B) e-commerce startup which connects informal retailers directly to local and multinational suppliers; and Flutterwave is a US-headquartered company that provides a payment infrastructure for global merchants and payment service providers across Africa.

2022 also saw fintech exits accelerate, an indicator of the sector’s maturing. Notable merger and acquisition (M&A) transactions last year include Orchestrate, a payment orchestration startup from Nigeria, which was acquired in July by fintech and banking-as-a-service (BaaS) infrastructure provider Bloc; Underlie, an open banking startup from Egypt which was acquired in December by United Arab Emirates (UAE)-based open finance platform Fintech Galaxy; and Retail Capital, an award-winning business lending company from South Africa that was acquired by digital banking startup TymeBank.

Rising fintech adoption

Fintech adoption has increased steadily over the past couple years, but has accelerated since the beginning of COVID-19. With usage of cash on the decline, fintech has provided solutions for many consumers and merchants in the region to transact.

The FT Partners report outlines a handful of key fintech markets in the continent: South Africa, a tertiary-driven economy, have developed into one of the most sophisticated financial and fintech ecosystems in Africa; Nigeria has grown to become the largest fintech ecosystem in Africa heavily focusing on consumers and small and medium-sized enterprises (SMEs); Egypt, one of the largest economies in the continent, has been among the earliest fintech pioneers in Africa, benefiting from its close ties with the Gulf; Kenya, one of the fastest-growing economies in the continent, was a trailblazer in mobile money payments which it has since expanded to other African nations.

Moving forward, FT Partners expects the fintech momentum to carry on, building on favorable market factors including the region’s massive, young, unbanked and underbanked, tech-savvy population, high reliance on cash, increasing mobile penetration, and a generally favorable regulatory environment along with governments pushing for greater financial inclusion and digitization.

In Africa, roughly 90% of payments are still being conducted in cash, and more than half of the continent’s popularity are unbanked or underbanked. This makes Africa one of the “greatest long-term secular growth opportunities for fintech globally,” FT Partners claims.

A 2022 McKinsey report reveals that fintech revenues reached US$4-6 billion in 2020, with average penetration levels ranging between 3% and 5% (excluding South Africa). African fintech revenues are projected to reach eight times their current value by 2025, soaring to an estimated US$30 billion.

Image: Growth rate of financial services market revenue by product in Africa, US$ billion, Source: McKinsey; World Bank Group

Fintech has grown to become the most vibrant startup sector in Africa. In 2021, the fintech sector accounted for 27% of the number of deals closed, and 61% of the region’s total funding, according to a 2022 Mastercard report.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.