In Nigeria, agricultural technology (agritech) entrepreneurs are leveraging technology and digital platforms to help tackle the massive funding gap faced by small and medium-sized agriculture businesses. This burgeoning sector is attracting the interest of funders and gaining support from organizations from across the globe who’ve been eager to back some of the region’s most innovative ventures.

Just last month, ThriveAgric bagged the grand prize of the 2022 Visa Everywhere Initiative (VEI) and was recognized for its ingenuity in applying technology to solving agricultural challenges.

VEI is a global open innovation program which seeks to uncover the world’s most innovative startups solving payment challenges and help transform commercial experiences.

Founded in 2017, ThriveAgric is a agritech company that aims to empower smallholder farmers across Africa. The company assists smallholder farmers in accessing finance as well as improving productivity and sales. Harvests, including maize, rice and soybeans, are stored in many of the company’s 500+ warehouses across Nigeria, before being commoditized and offered to local and global trade markets at a premium price.

ThriveAgric has developed a proprietary technology called the Agricultural Operating System (AOS) that’s used by field agents and farmers to provide finance and enable sales for their harvest while digitizing commodities. The system works entirely offline, capturing farmer onboarding and credit scoring, as well as other relevant farm data. It links farmers to capital, data-driven best practices, and access to local and global markets.

ThriveAgric, which won both the global and Central Europe, Middle East and Africa (CEMEA) competition, competed against more than 4,000 startups from across the world, among which 1,130 contenders from CEMEA.

In his acceptance speech, Ayo Arikawe, co-founder and CTO of ThriveAgric, stressed the critical role agriculture is playing in the Nigerian economy, adding that his company is enabling strategic partnerships with financial institutions and players in the whole value chain to provide farmers with financial services, agriculture inputs, extension, market linkage, e-commerce, and payment services.

“As a central part of the Nigerian economy, agriculture is the livelihood and main source of income for many of our people,” Arikawe said. “The hard work we’ve put into ThriveAgric will ensure that technology is leveraged to empower farmers across the country. To not only win the CEMEA regional VEI competition but also pitch at the final here in Qatar gives me great confidence in our ability to scale our solutions and continue to enrich farmers’ lives.”

The win of the 2022 VEI competition is the latest achievement ThriveAgric has recorded over the past year. In March 2022, the startup raised US$56.4 million in debt funding after witnessing its revenues increase five-fold over the prior 12 months.

ThriveAgric, which claims a farmer base of more than 350,000 businesses and says it has provided farmers with over 150,000 tons of fertilizers and seeds in loans, as well as produced and traded up to 800,000 metric tons of grains, is now working on entering new African markets, including Ghana, Zambia and Kenya.

Nigeria’s burgeoning agri-fintech industry

ThriveAgric is part of a burgeoning community of agri-fintech startups that have been founded in Nigeria over the past few years to serve the financial needs of the country’s farmers and agricultural sector. Alongside ThriveAgric, other noteworthy names include Agrorite, AgroMall, Crop2Cash and HerVest.

Agrorite is the operator of a digital agriculture platform that provides smallholder farmers with financing, aggregation, food processing and trading, commodity trading, agricultural technology, and insurance.

Since its inception in 2019, the company says it has amassed a network of over 130,000 farmers, approximately 125,000 hectares of cultivated farmland, with about 350,000 metric tons of cultivated agricultural produce traded across Nigeria. This is in addition to managing commodity trade for more than ten agricultural commodities.

AgroMall, a company founded 2016, uses technology and data to facilitate digital agriculture finance, enhance production, reduce post-harvest losses and improve access to markets for Nigeria’s smallholder farmers. The company is said to have accumulated 530,000 customers.

Crop2Cash provides smallholder farmers with access to formal financing for agricultural inputs and enables them to receive digital payments, as well as access to other digital financial services such as access to credit. The company has recorded strong growth over the past few years, witnessing its userbase rise from just 25,000 in 2020 to 300,000 in 2022.

HerVest is a relatively young startup founded just in 2019 that stands out from the crowd for its focus on underserved and excluded women in Africa. HerVest’s mission is to improve women’s lives through greater access to financial services and products, including savings, impact investing and credit, as well as loans specifically designed for small holder female farmers.

More than 80% of Nigerian farmers are smallholder farmers whom collectively account for 90% of the agricultural produce in the country, according to Babban Gona, a social enterprise organization based in Lagos that support smallholder farmers.

Despite the critical role these farmers play in the local economy, most still struggle to secure the financing they need to invest in their farms and improve production.

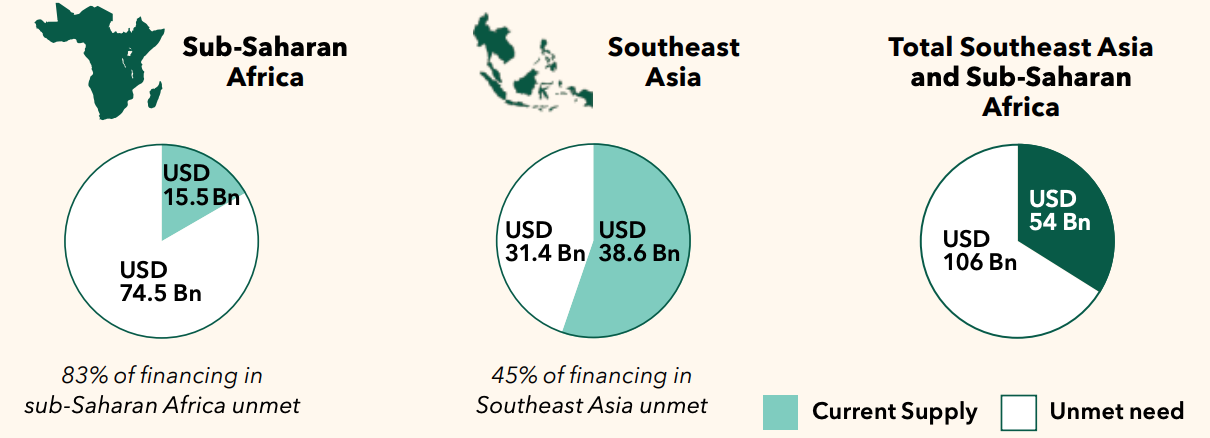

ISF Advisors, a sector-specific strategy group, estimates that small and medium-sized agriculture businesses in sub-Saharan Africa are facing a US$74.5 billion funding gap.

Around 130,000 “agri-SMEs” in sub-Saharan Africa have a total financing need of US$190 billion but only a mere 17% of that (US$15.5 billion) is currently being met through formal channels, it said in a 2022 report.

Agri-SME finance gap in developing markets, Source: The state of the agri-SME sector: Bridging the finance gap, ISF Advisors, March 2022

2022 Nigeria fintech map

Nigeria’s fintech industry has evolved steading over the past year, growing from 184 companies in 2021 to 236 companies, as of December 2022, according to Segun Adeyemi, co-founder and CEO of Anchor, a banking-as-a-service (BaaS) startup from Nigeria.

In 2022, the market saw the rise of a number of trends and segments, including fintech business-to-business (B2B) marketplaces, asset finance companies, BaaS and agency banking, the fintech entrepreneur notes.

That being said, lending and payments remained the top fintech segments in the Nigerian market, collecting 28 and 26 companies, respectively.

Featured image credit: edited from Freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.