PwC’s 2022 Global CBDC Index and Stablecoin Overview has ranked Nigeria at the top of the retail leaderboard, recognizing the work done by the Central Bank of Nigeria (CBN) in developing and deploying the eNaira, a digital form of the domestic currency.

Launched October 2021, the eNaira is the culmination of several years of research work by the central bank. The retail central bank digital currency (CBDC) is intended to usher in a monetary system that’s more inclusive, improve access to digital financial services, and enhance the efficiency of payments.

The first CBDC to be deployed in Africa, the eNaira is set to support the country’s target to raise levels of financial inclusion from 64% in 2020 to 95% by 2024, and to increase Nigeria’s gross domestic product (GDP) by US$29 billion over the next 10 years.

So far, uptake of the digital currency has been promising with 7,300 downloads of the eNaira wallet per day in Q1 2022. In Q2 2022, app downloads are projected to accelerate to about 10,000 downloads per day, a source told local newspaper Vanguard earlier this month.

The PwC Global CBDC Index and Stablecoin Overview 2022, the second edition of the index, charts the readiness and adoption of CBDCs around the world, measuring central banks’ progress and stance on digital currency development in both a retail and wholesale context.

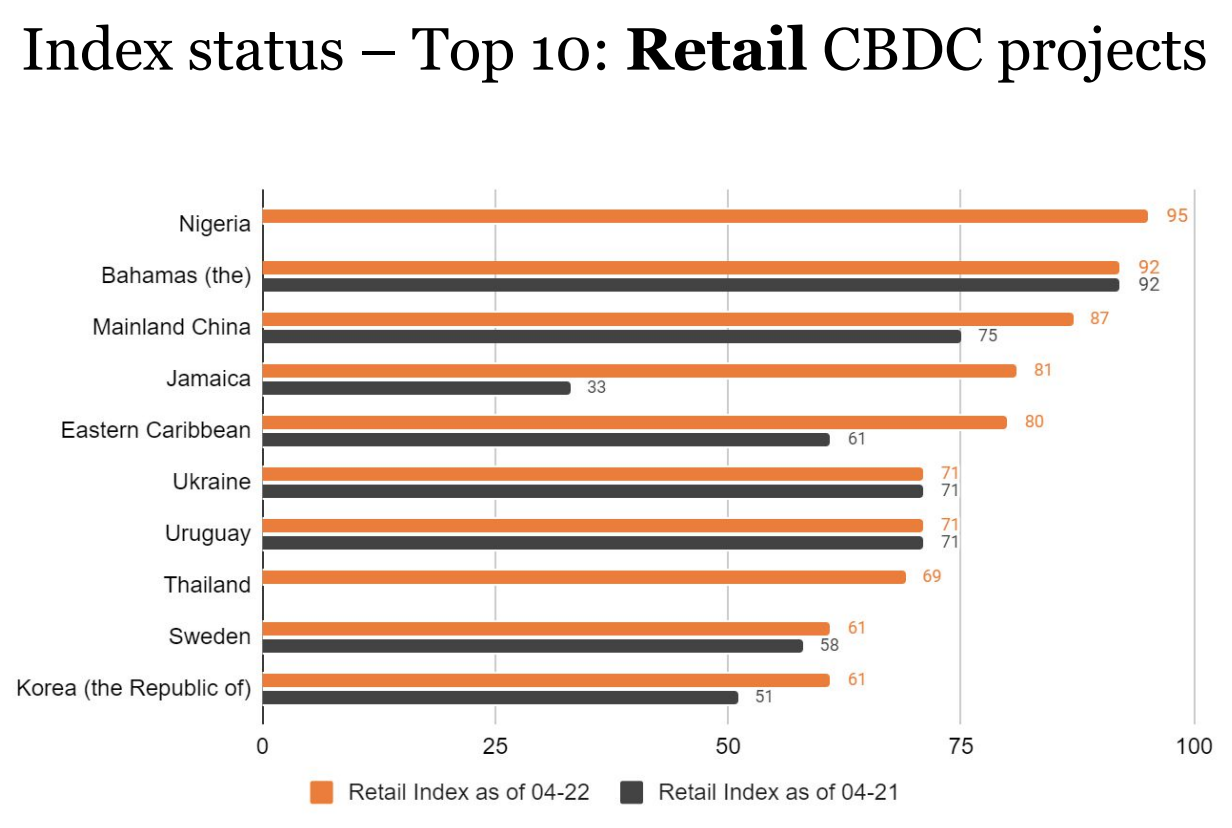

Nigeria’s lead on the retail CBDC chart is closely followed by the Bahamas, the first country in the world to officially launch a retail CBDC called the Sand Dollar back in October 2020, and Mainland China, the first major economy to pilot a retail CBDC in 2020.

As of late 2021, China’s retail CBDC pilot, which has been running in several major cities and provinces including Shenzhen, Shanghai and Chengdu, recorded 261 million individual wallets being set up and CNY 87.5 billion (US$13.78 billion) worth of transactions being made.

Nigeria is one of the three new entries in the 2022 Retail CBDC Index Top 10, alongside Jamaica, which plans to launch the digital Jamaican dollar this year after a successful pilot in 2021, and Thailand, which will begin testing its retail CBDC in late 2022.

These three new entries replace Cambodia, Ecuador and Turkey. Cambodia was removed from the list because its Bakong project is defined as a digital payment system, rather than a CBDC. Ecuador cancelled its Dinero electronico project and the initiative has not been included on the central bank’s agenda for these past couple of years. And Turkey fell outside top 10 as other jurisdictions gained more maturity points.

Top 10: Retail CBDC projects, Source: PwC Global CBDC Index and Stablecoin Overview 2022

Wholesale CBDC index: Hong Kong/Thailand collaboration tops ranking

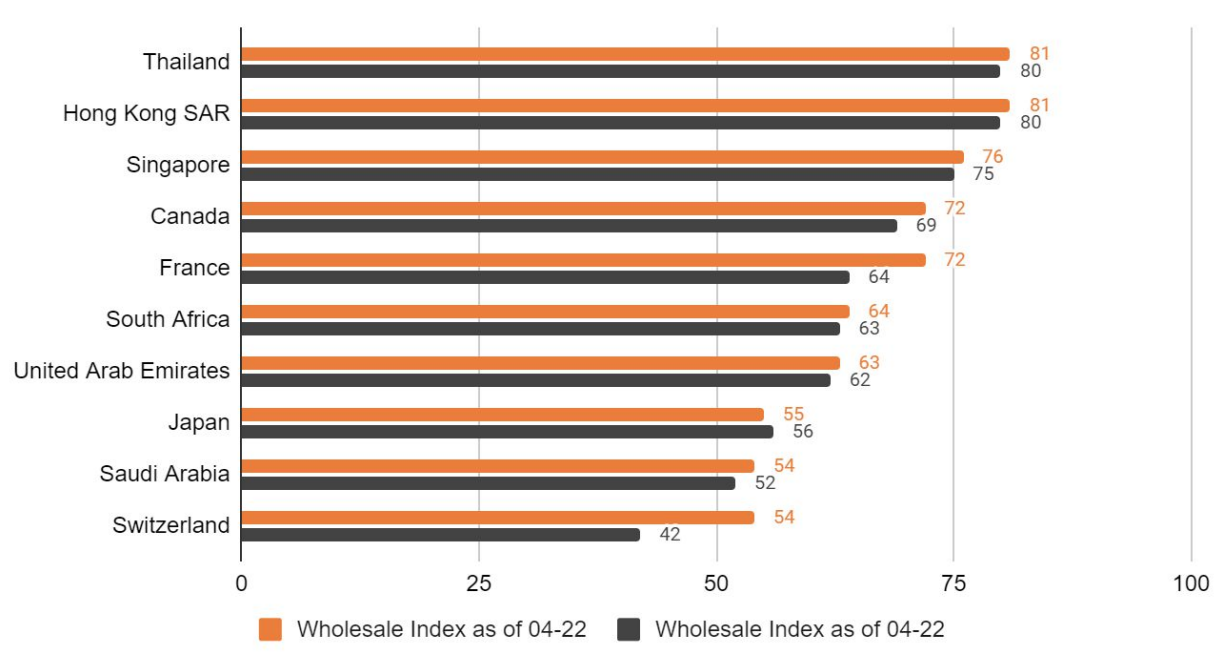

On the wholesale side, the mBridge project spearheaded by the Hong Kong Monetary Authority (HKMA) and the Bank of Thailand (BoT) is ranked as the most advanced wholesale CBDC initiative in the world.

mBridge, formerly known as Inthanon-LionRock, seeks to build a multi-CBDC platform that makes use of distributed leger technology (DLT) to enable real-time, cross-border foreign exchange payments. Since the start of the collaboration, mBridge has welcomed the Central bank of the United Arab Emirates (UAE) and the Digital Currency Institute of the People’s Bank of China into the initiative as well as 22 private sector participants, including Standard Chartered, HSBC, UBS and Societe Generale.

Also ranked highly is the work of the Monetary Authority of Singapore (MAS), which has been researching and experimenting with CBDCs since 2016. MAS has been involved in a total of five different CBDC initiatives:

- Project Ubin, which sought to use blockchain and DLT for clearing and settlement of payments and securities;

- Multi-Currency Corridor Network, a collaboration with Banque de France to experiment on wholesale cross-border payment and settlement using CBDC;

- Project Orchid, a partnership with the private sector to build the technology infrastructure and technical competencies necessary to issue a digital Singapore dollar;

- Project Dunbar, a collaboration with the Bank for International Settlements (BIS) Innovation Hub Singapore Centre, the Reserve Bank of Australia, Bank Negara Malaysia and the South African Reserve Bank to test the use of CBDCs for international settlements; and

- The Global CBDC Challenge, which seeks innovative retail CBDC solutions to enhance payment efficiencies and promote financial inclusion.

The 2022 Wholesale CBDC Index Top 10 includes two new entries: Saudi Arabia, which moved up two places, rising from the 11th place in 2021 to 9th in 2022; and Switzerland, which rose from the 12th place in 2021 to 10th in 2022.

These two new entries replace the UK and the Eurozone. The Bank of England has not yet made a decision on whether to introduce a CBDC in the UK. A consultation will be launched this year to determine whether or not the authorities will move into a development phase.

In the European Union (EU), the European Central Bank is currently carrying out in-house experiments with a digital euro for the retail payments landscape. The authority expects to start working on a prototype at the end of 2023 after the introduction of a new bill that would serve as the legal foundation for its technical work. So far, no plans for a wholesale CBDC have been announced.

In Switzerland, the central bank recently concluded Project Helvetia, a multi-phase investigation with the BIS Innovation Hub and financial infrastructure operator SIX. Project Helvetia successfully demonstrated that it is possible to integrate a wholesale CBDC into existing core banking systems and processes of commercial and central banks.

The Swiss National Bank was also involved in Project Jura, an initiative that sought to explore the direct transfer of euro and Swiss franc wCBDCs between French and Swiss commercial banks on a single DLT platform operated by a third party.

Top 10: Wholesale CBDC projects, Source: PwC Global CBDC Index and Stablecoin Overview 2022

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.