Global crypto adoption is being propelled by emerging markets, and crypto in Africa is at the forefront of this.

As of August this year, peer-to-peer (P2P) bitcoin trading volumes in sub-Saharan Africa on crypto trading platforms LocalBitcoins and Paxful crossed US$18 million, the highest in the world (surpassing trading volumes in North America for the first time).

At Luno, another crypto trading platform, African users represent 45% of the one million customers it newly added since June this year. Meanwhile, pan-African crypto exchange Yellow Card raised US$15 million in a Series A round this year to boost expansion.

In Congo, Bitcoin has helped Congolese refugees build back their local economy after they were displaced by a natural disaster. Meanwhile in Nigeria, the devaluation of the naira means that people are becoming more interested in crypto as an alternative for business and remittances, aside from protecting their savings.

The picture is clear – crypto in Africa is taking off despite an unfavorable regulatory outlook.

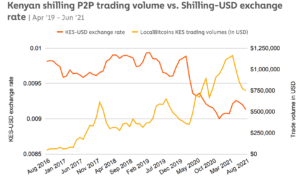

Six African countries were amongst the top nations driving crypto adoption worldwide, a 2021 report by Chainalysis showed. According to the 2021 Global Crypto Adoption Index, Kenya, Nigeria, Togo, South Africa, Ghana, Tanzania all featured in the top 20. Both Kenya and Nigeria, two of Africa’s biggest fintech hubs, ranked high on the index for transaction volumes on P2P platforms as well.

More tellingly, although Africa received just 3% of global crypto by value, it was the third-fastest growing cryptocurrency economy in the world, according to the report.

Crypto in Africa: What the numbers say

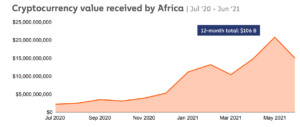

The total crypto value received in Africa has gone from under US$5 billion, to as much as US$20 billion, in just one year (between July 2020 to June 2021). This represents a growth of 1200%.

For the period, the total value of the crypto received by the continent stood at US$106 billion, 96% of which was received from foreign sources. In fact, Africa had the highest cross-region transfers than any other region in the world.

The overall transaction volume of retail-sized transfers in Africa was also higher than any other region, at over 7%, compared to a global average of 5.5%.

The reason behind this surge in activity surrounding crypto in Africa is a fractured financial system that does not seem to be working well for local populations.

Moving money in Africa was described as a “veritable nightmare” and “almost impossible” by Paxful CEO. Transfer costs can go as high as 9% in sub-Saharan Africa. Crypto platforms, on the other hand, come in much cheaper at 2-5%.

In this backdrop, the Chainalysis report noted that issues, such as limits on how much money can be sent abroad through formal networks, has led to an increase in crypto remittance payments.

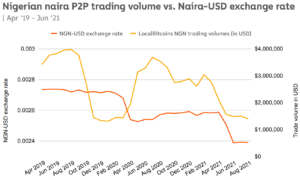

Meanwhile, currency devaluations in places such as Kenya and Nigeria have led people to invest in crypto as a means to protect their savings from further erosion.

Regulators are not onboard with crypto in Africa

Although adoption of crypto in Africa is on the rise, African regulators are not quite having it. A rise in crypto-related scams, for instance, has resulted in South African regulators looking to tighten the oversight of crypto assets through a new regulatory framework. Nigeria, meanwhile continues to take a stern approach to crypto trading, with its latest official warning released just this year (the first note of caution came in 2017).

However, regulatory stances are shifting ever so slightly from complete disapproval to regulatory consideration.

In 2017, the Reserve Bank of Zimbabwe issued its first public warning against crypto trading, as did the Central Bank of Kenya in 2015. Now, the Zimbabwe federal government is scoping out a comparison between CBDCs and crypto in Africa. Kenya’s Capital Markets Authority, meanwhile, held early interactions with innovators working on crypto solutions through a sandbox initiative.

This regulatory pushback has not dampened spirits, however. In Nigeria’s case, cryptocurrency trading volumes are amongst the highest in the world, despite an ongoing crackdown by the Central Bank of Nigeria.

The promise of crypto in Africa is to usher in financial empowerment and liberty by circumventing the traditional financial system. Local populations are left with little choice apart from buying in, despite the high inherent risks of a crypto-driven economy.

As hit pop artist Akon put it, “So, what does a crypto-fuelled Africa look like? To me, it looks like a utopia.” (Akon’s own cryptocurrency Akoin is available in 11 African countries, apart from the US.) How much of a utopia it will turn out to be depends on who wins this tug-of-war between a historically centralised financial system, and a highly risky (and young) crypto industry.

4 Comments so far

Jump into a conversation