Africa-focused fintech Pngme has secured US$15 million in Series A round of funding, the San Francisco- and Sub-Saharan Africa-based company has announced.

The funding comes within a year of the startup’s US$3 million seed round.

London-based VC fund Octopus Ventures led the round. Participating investors included Lateral Capital, Unshackled Ventures, Raptor Group, EchoVC, Future Africa, Aruwa Capital Management, Two Small Fish Ventures, and The51.

The funding round also saw angel investors pitch in. These included Rally Cap Ventures Founder Hayden Simmons, Plaid’s Dan Khan, former COO of RBC Capital Markets Richard Talbot, Intersect VC Partner Kyle Ellicott, mentors from Creative Destruction Lab, and others.

The funding will be used to grow the company’s financial data infrastructure and machine learning-as-a-service platform. Specifically, the company will be expanding its executive team, and has hired new CSO Lorraine Kageni Maina, and new CTO Nick Masson towards the same. It is also expanding its data science, engineering, product, and sales teams globally.

Cate Rung

“Pngme’s infrastructure has processed billions of data points from hundreds of financial institutions across sub-Saharan Africa and we plan to double down on our Insights Library and expand our third-party data connections to other markets over the next year,”

Cate Rung, Co-founder and COO of Pngme, said about the company’s plans.

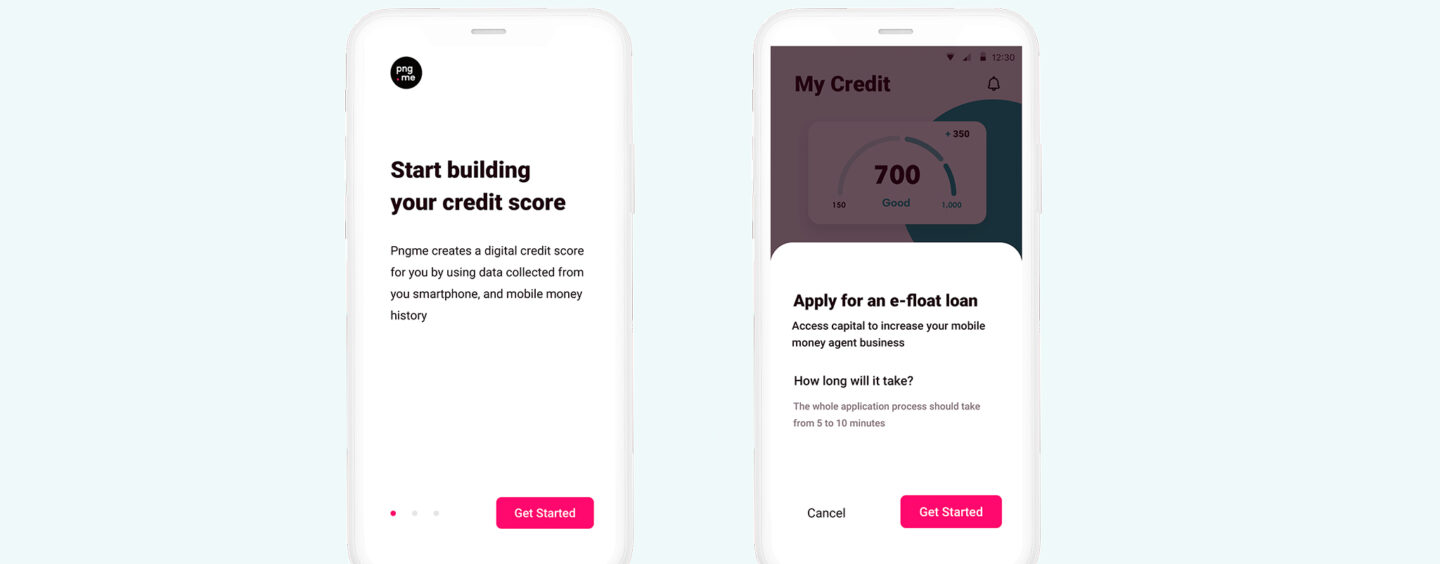

Pngme provides data analytics and machine learning fintech solutions

Pngme offers an API, a mobile SDK and a customer management platform to build personalised, data-driven user fintech experiences.

The company’s solutions aim to help financial institutions and fintechs lower customer acquisition costs, while increasing their lifetime value, TechCrunch reported.

With the Series A, Pngme has raised a total of US$18.5 million so far, becoming the most funded fintech in its category (which includes Stitch, Okra, Mono and OnePipe), the report further stated.

The company’s clients include tier-one banks in Nigeria and South Africa, fintech companies Kuda, Umba, Renmoney, CredPal, and credit bureaus such as TransUnion Africa, it also said.

1 Comment so far

Jump into a conversation