Morocco Grabs the Third Spot in Arab’s Fintech Space Behind UAE and Egypt

by Fintechnews Africa 19 April 2021Morocco is the third largest fintech hub in the Arab world, hosting 13% of all 400 active fintech solutions, or about 40 fintech solutions, according to a research by financial inclusion think tank Consultative Group to Assist the Poor (CGAP).

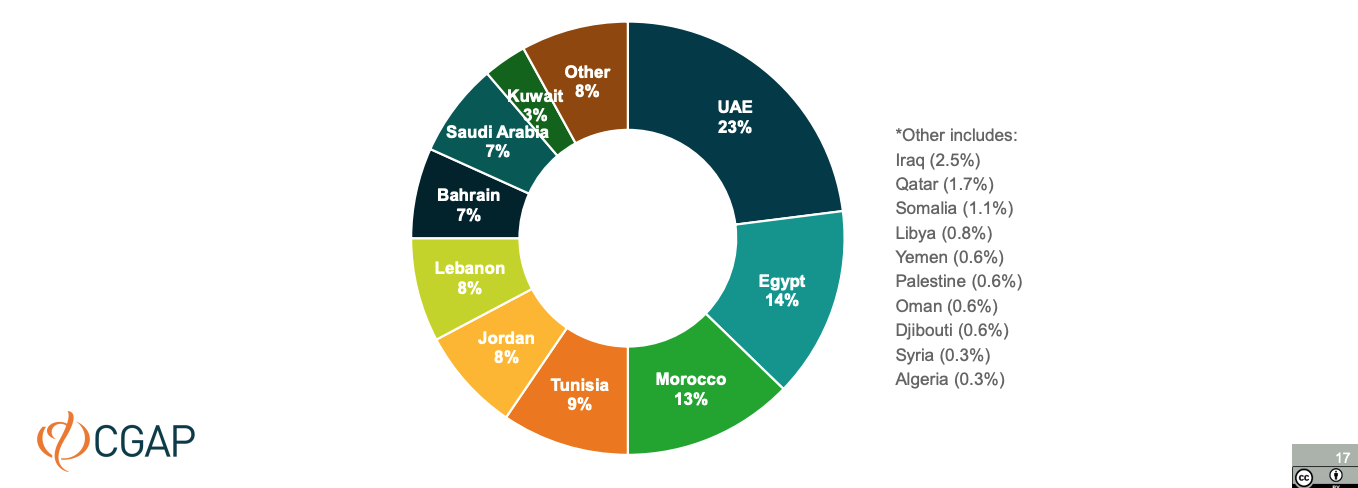

The report, titled Fintechs Across the Arab World, looks at the fintech ecosystem across the 22 member countries of the Arab League, and how the sector has grown over the past years. CGAP identified 400 fintech solutions offered by over 320 unique fintech providers in the region as of November 2020. The United Arab Emirates (UAE) hosted the most fintechs (23%) followed by Egypt (14%) and Morocco (13%).

Fintech solution geographical distribution, Fintechs Across the Arab World, CGAP, Dec 2020

A deep dive into Morocco’s fintech landscape highlighted the country’s high mobile coverage, the large population of unbanked, an abundant supply of talent, and numerous government initiatives encouraging uptake of digital financial services as the key drivers of fintech growth in Morocco.

Total banking penetration in Morocco stood at just 28.6% in 2017 and the economy remains largely cash-based with around 80% transactions made using cash. At the same, e-commerce is experiencing solid growth, driving with it online transactions which grew 43% in December 2020, compared to January 2020’s volume, Mikael Naciri, the CEO of Interbank Electronic Banking Centre (CMI) said in January 2021.

Infrastructure upgrades such as the Electronic National Identity Card (CNIE) and government initiatives including regulatory changes in banking laws, are also contributing to the growth of fintech, an August 2020 report by CGAP and EY noted.

Morocco’s fintech startups

Out of the 40+ active fintech solutions in Morocco, payment, remittance and point-of-sale (POS) systems are the most developed segment. Invyad provides a mobile, end-to-end POS solution for small and medium-sized enterprises (SMEs); Wafacash is a remittance startup; and Inwi Money and HmizatePay specialize in mobile payments. HmizatePay is the mobile payment platform of e-commerce startup Hmizate.

OnePay is a relatively newcomer. Founded just last year, OnePay enables both offline and online businesses to receive digital payments. Its platform acts as an aggregator for payments and value-added services. OnePay raised US$400,000 in July 2020.

Other paytech companies in Morocco include Societe Maghrebine de Monetique (S2M) and NAPS, a subsidiary of M2M Group.

Crowdfunding, personal financial management, lending and data analytics are other fintech segments present in the Moroccan fintech sector. Cotizi is Morocco’s first crowdfunding platform; Ciwa is a mobile app for the creation and management of tontines; MeilleurCreditImmo.ma, formerly SOS Credit, offers online mortgage brokerage services; and Peaqock Financials is a provider of data analytics, visualization and management services.

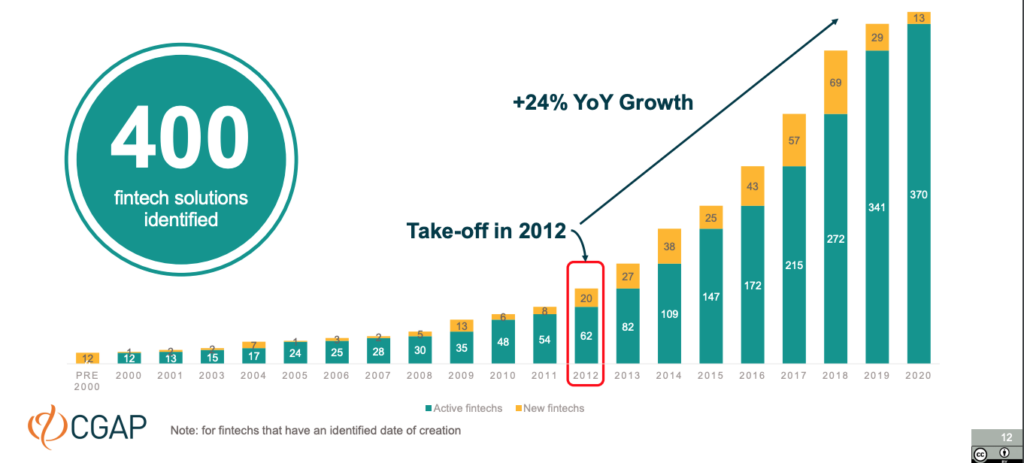

In the Arab World, which includes countries located in North Africa, the Horn of Africa and Western Asia, saw the number of fintech solutions grow more than 24% year-over-year (YoY) since the take-off in 2012.

New fintech solutions per year, Fintechs Across the Arab World, CGAP, Dec 2020

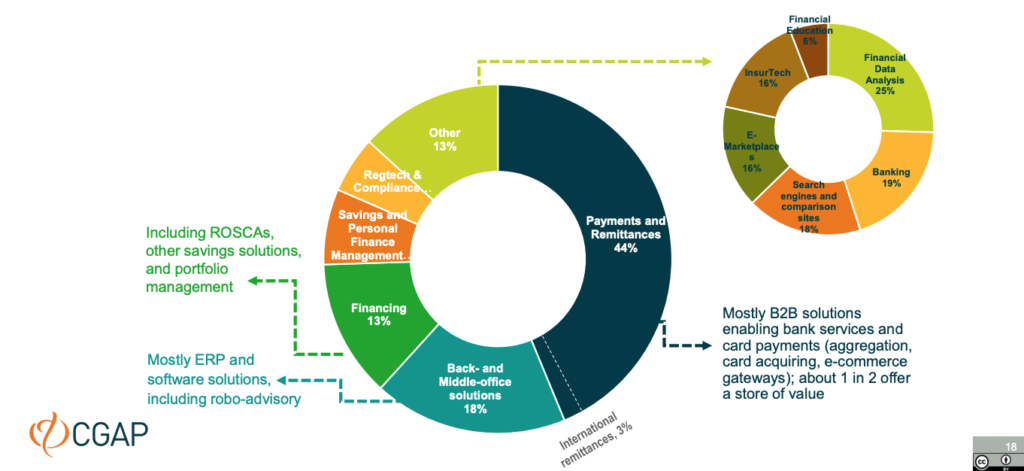

These fintechs primarily operate across countries in the Gulf Cooperation Council (GCC), among which Bahrain, Kuwait and Saudi Arabia, and specialize in payments and remittances (44%). Other top fintech segments in the Arab include back- and middle-office solutions (18%) and financing (13%), the CGAP research found.

Fintech segments distribution, Fintechs Across the Arab World, CGAP, Dec 2020

This article first appeared on fintechnews.ae

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.